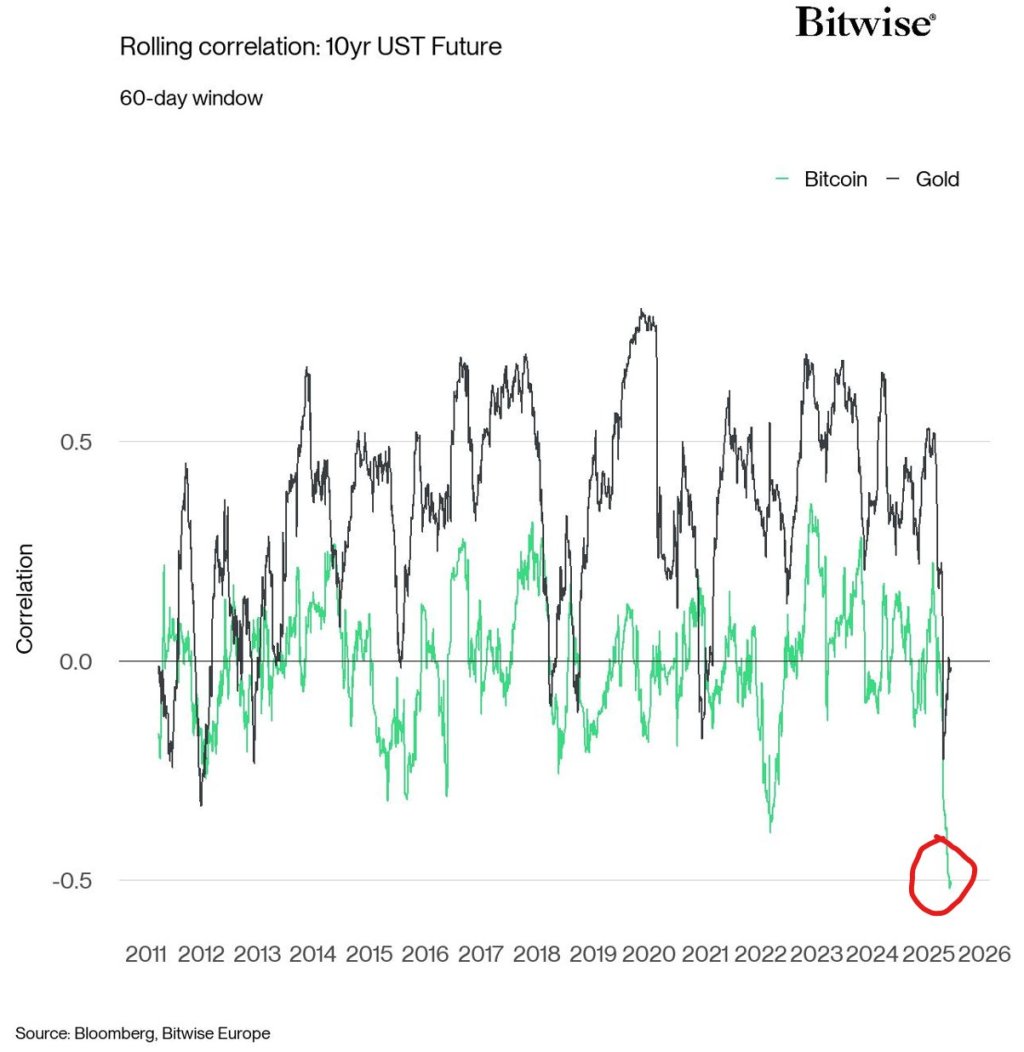

A single information collection is up-ending a long time of portfolio concept. On 29 Might, André Dragosch, PhD, European head of analysis at Bitwise, posted a chart displaying that the 60-day rolling correlation between Bitcoin and 10-year US Treasury-bond futures has collapsed to its most detrimental studying on document.

Bitcoin Vs. 10-Yr US Treasury Futures

“That is in all probability crucial macro chart for bitcoin proper now… Bitcoin’s 60-day correlation to US 10yr Treasury Futures has declined to the bottom degree ON RECORD. Are conventional buyers promoting US Treasuries to purchase Bitcoin?” he wrote, framing the plunge as a watershed second for asset allocation.

Dragosch’s follow-up thread sharpened the purpose. “US Treasuries are damaged; there was a structural break in inter-market correlations since at the very least 2022… Bitcoin is an alternate portfolio insurance coverage in opposition to sovereign default as a counterparty-risk-free asset… International buyers have been transferring away from US Treasuries into exhausting property like gold and apparently bitcoin extra not too long ago… Evaluating Bitcoin’s market cap to gold solely is an out of date view—Bitcoin is more and more competing with sovereign bonds as a substitute retailer of worth.”

The structural cracks he cites are actual. Bitwise’s March “Macro Fault Line” report documented the deepest bear market in long-duration Treasuries in trendy historical past—greater than a 40 % drawdown—alongside yawning deviations in once-stable correlations between bonds, commodities and overseas yields. The analysis pinned the shift on post-2022 inflation shocks, swelling fiscal deficits and an exodus of overseas reserve managers from US debt.

BTC Exposes The Cracks In The System

Bloomberg’s Asia wealth survey final week confirmed the migration: high-net-worth shoppers, as soon as über-long greenback paper, are rotating into gold, Chinese language property and crypto, whereas China and different giant holders preserve trimming Treasury positions in favour of different reserves. On the similar time, the time period premium on the 10-year be aware—usually a cushion for bond buyers—has didn’t rise in line with deficits, hinting at latent liquidity danger.

Bitcoin has caught that bid US spot-Bitcoin ETFs drew a document web $6.35 billion in Might, lifting BlackRock’s IBIT alone to $71 billion in property below administration. These flows arrived at the same time as Treasury auctions stumbled, with a 20-year bond pricing above the when-issued yield and pushing buyers to demand nonetheless increased compensation for period danger.

Correlations again up Dragosch’s thesis. Bitwise information present BTC’s hyperlink to Treasuries is now far weaker than gold’s, but the cryptocurrency has traditionally outperformed bullion on days when bond costs fall sharply, underscoring its attraction as “portfolio insurance coverage” in a sovereign-debt drawdown.

None of this ensures a one-way commerce. Bitwise itself warns that tighter monetary situations can nonetheless buffet crypto costs, and BTC retains a significant connection to danger property throughout acute fairness sell-offs. However the course of journey in sovereign debt is forcing buyers to look elsewhere for one thing that can’t default or be debased. As Dragosch put it, “We’re going means, means increased.”

For conventional portfolio managers whose fashions nonetheless anchor on a constructive Treasury hedge, the chart Wall Avenue “doesn’t need you to see” is greater than a curiosity—it’s a signal that the 60/40 paradigm is splintering. The longer bond markets battle to fulfil their historic safe-haven function, the louder Bitcoin’s pitch as digital, bearer-asset insurance coverage is prone to turn out to be.

At press time, BTC traded at $105,780.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.