Alisa Davidson

Revealed: February 09, 2026 at 9:41 am Up to date: February 09, 2026 at 9:41 am

Edited and fact-checked:

February 09, 2026 at 9:41 am

In Transient

A brand new report by The Blockchain Heart Abu Dhabi and Binance reveals that the UAE has transitioned from blockchain experimentation to large-scale, regulated deployment, establishing institutional-grade infrastructure throughout finance, governance, and public providers.

The Blockchain Heart Abu Dhabi has revealed a complete report inspecting the United Arab Emirates’ development from preliminary blockchain experimentation to large-scale, regulated implementation throughout finance, governance, and public-sector providers.

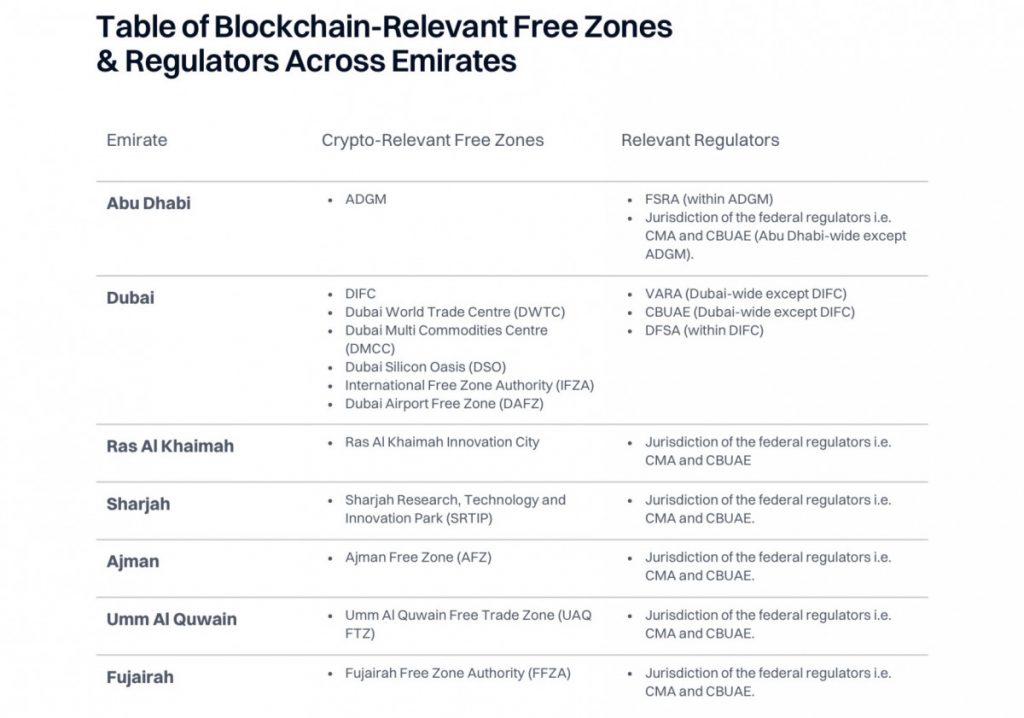

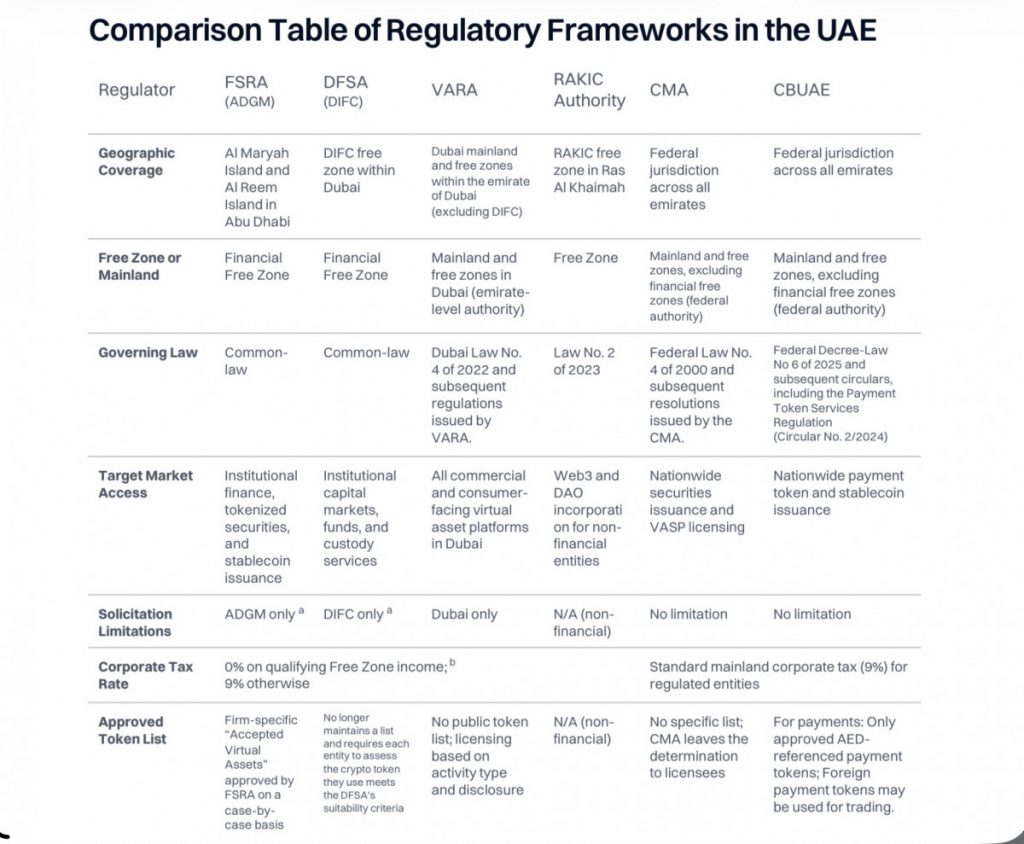

The report attributes the nation’s institutional adoption of blockchain in funds, tokenization, custody, and market infrastructure to its layered regulatory framework, which has established blockchain as a foundational part of the nationwide financial system.

The research was co-authored with Binance, recognizing the corporate’s transition from a worldwide cryptocurrency change to a supplier of institutional-grade digital asset infrastructure each globally and inside the UAE’s regulatory setting.

UAE Blockchain Ecosystem Matures: Contributors Drive Institutional-Scale Adoption, Regulatory Readability, And Multi-Billion-Greenback Deployments

The report notes that the UAE has entered a section of execution outlined by scale, regulatory readability, and institutional deployment. Proof of adoption is mirrored in operational, regulated initiatives, together with a nationwide digital id system serving 11 million customers, a number of DFSA- and FSRA-approved stablecoins, a central financial institution digital foreign money in pilot with preliminary transactions accomplished, and real-world asset tokenization tasks exceeding $4 billion in actual property alone.

These deployments are built-in right into a funds and remittance ecosystem of serious scale, with home cost techniques processing over AED 20 trillion in transfers in the course of the first ten months of 2025, and the UAE rating among the many world’s largest sources of outbound remittances.

The analysis additional highlights a structural transformation inside the UAE’s blockchain ecosystem, shifting from early-stage startups to an institutional panorama that now consists of regulated exchanges, custodians, cost suppliers, tokenization platforms, infrastructure distributors, enterprise options, banks, and multinational expertise companies.

Within the report blockchain is framed as important nationwide financial infrastructure, corresponding to transformative applied sciences similar to telecommunications and railways. Key reside implementations embody real-world asset tokenization, stablecoins and AED-backed tokenized deposits, funds and wholesale settlement platforms, in addition to blockchain-based commerce, logistics, and authorities providers.

The UAE Cross digital id system helps 11 million customers with over 2.5 billion authentications, whereas sovereign and quasi-sovereign capital exceeding USD 2.5 trillion contributes to the scaling and compliance of blockchain initiatives.

Binance’s integration inside the UAE’s institutional framework, as an ADGM FSRA-regulated entity, displays the nation’s emphasis on compliant, large-scale digital asset infrastructure. The 2025 USD 2 billion funding by MGX into Binance, performed utilizing regulated stablecoin infrastructure, additional demonstrates the UAE’s dedication to institutional blockchain infrastructure.

The Blockchain Heart Abu Dhabi And Binance Spotlight UAE As A International Chief Iin Institutional Blockchain Infrastructure

“Binance selected to accomplice on this analysis as a result of we share the UAE’s imaginative and prescient of blockchain as a important pillar of future financial infrastructure,” mentioned Tarik Erk, Regional Head for MENAT and Senior Govt Officer, Abu Dhabi at Binance, to MPost.

“The nation’s clear regulatory framework and give attention to institutional-grade deployment align completely with our dedication to constructing safe, compliant, and scalable digital asset options. Collaborating with The Blockchain Heart Abu Dhabi permits us to contribute meaningfully to the UAE’s transition from blockchain experimentation to execution at scale, reinforcing our dedication to supporting real-world use instances inside a trusted, regulated setting,” he added.

The Blockchain Heart Abu Dhabi and Binance report positions the UAE as a worldwide reference level for institutional blockchain infrastructure, emphasizing how coordinated regulatory design and ecosystem alignment have enabled blockchain to operate as production-grade infrastructure relatively than a speculative expertise.

Disclaimer

In keeping with the Belief Venture tips, please observe that the data supplied on this web page shouldn’t be supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. You will need to solely make investments what you possibly can afford to lose and to hunt impartial monetary recommendation when you have any doubts. For additional info, we propose referring to the phrases and circumstances in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Creator

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.