The relentless rally in Treasury yields and the US greenback is giving inventory buyers pause. Merck has a basic and technical growth.

Friday’s TLDR

Rising yields are value watching

So is a rising greenback

Breaking down Merck inventory

The Backside Line + Day by day Breakdown

We rode by 2024 with a couple of gentle corrections within the inventory market, however ended with spectacular features. Bitcoin had its ups and downs too, however capped the 12 months with a large rally, topping $100,000 for the primary time.

With a lot momentum going into December, why then have threat property like shares and crypto been wavering currently?

Earlier this week, I talked about the rising US greenback and rising Treasury yields, that are performing as headwinds for shares.

Now, it’s value mentioning that these correlations don’t essentially (or all the time) transfer in lockstep. Shares can rally whereas yields and/or the greenback are transferring greater. In reality, threat property have moved greater since each yields and the greenback bottomed in September. However when the greenback and yields are rising — significantly when they’re rising in a considerably relentless method and doing so collectively — it might weigh on threat property.

The Greenback

A rising greenback squeezes the income for multinational corporations. Consider US corporations that do enterprise in different nations. The gross sales they generate in native currencies (like euro) are actually value much less once they convert them to {dollars}. This weighs on earnings, which is a significant factor in whether or not shares go up or down.

The US Greenback will be adopted right here on eToro. Discover the way it’s up virtually 10% from the lows in September — that’s a giant transfer for the greenback.

There are positives to the next greenback, too. Touring overseas is cheaper, whereas import costs are additionally decrease. On the flip facet although, touring to the US turns into costlier for overseas vacationers. There are numerous transferring elements with currencies.

Treasury Yields

Once we take a look at rising yields, Treasuries are competing with shares and are sometimes thought-about “threat free” from a principal standpoint. When the yield of those so-called “risk-free” property will increase, it makes them extra engaging vs. different property, like shares.

Proper now, the regular transfer greater in yields is creating some pause for inventory buyers.

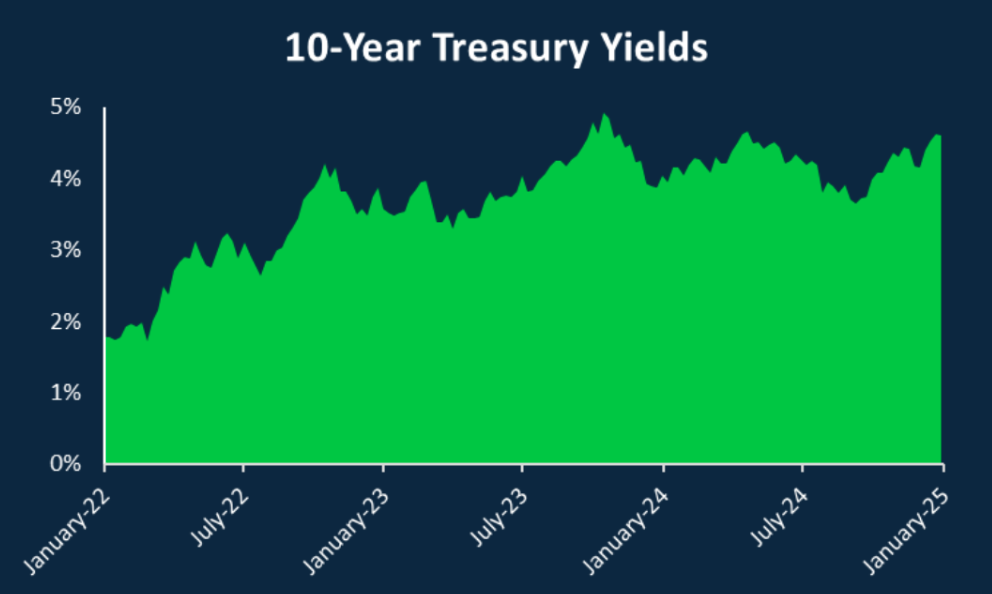

Yields started rising in mid-September — satirically proper round when the Fed first lower charges — and at this week’s excessive, the 10-year Treasury yield was up a whopping 30.9% from the September lows when it was buying and selling round 3.6%.

After clearing the 4.5% mark, there’s a rising fear that the 10-year will shoot again as much as 5% prefer it did in October 2023. Yields topped round that mark — and that’s additionally when shares bottomed amid an ~11% pullback within the S&P 500.

That’s not a prediction for the present scenario, however simply provides some context to the present setting.

The Backside Line

Buyers need to do not forget that risk-assets don’t go up in a straight line. Deep down, buyers know this, however this actuality can get misplaced within the shuffle as soon as our feelings become involved and we begin to see some purple ink in our portfolios.

If the greenback and yields proceed to rise, it will increase the percentages that these grow to be bigger headwinds and put extra strain on threat property. On the flip facet, yields and the greenback aren’t the end-all, be-all for shares, and will they transfer decrease, it may benefit shares and crypto.

Wish to obtain these insights straight to your inbox?

Enroll right here

The setup — Merck

Merck is a reputation that’s grow to be fascinating once we mix the basics and technicals collectively.

Particularly, the inventory is breaking out over downtrend resistance on the every day chart and is close to an space on the weekly chart that’s typically been help. On the elemental facet, the inventory is buying and selling close to a historic trough once we take a look at the price-to-earnings and price-to-free-cash-flow valuations. Lastly, analysts anticipate Merck to generate earnings and free money stream development in extra of 20% in 2025.

(I wrote a deep-dive on Merck earlier this week, for these ).

Above is the every day chart, highlighting the current breakout in MRK shares. If the inventory is ready to hold this breakout intact, extra bullish momentum could possibly be on the best way.

Nevertheless, lively buyers who wish to hold a decent threat profile can think about using a stop-loss under the current low close to $94 in an try to comprise their losses. Bear in mind, shares can all the time hole down under your anticipated stop-loss.

Choices

For some buyers, choices could possibly be one various to take a position on MRK. Bear in mind, the danger for choices consumers is tied to the premium paid for the choice — and dropping the premium is the total threat.

Bulls can make the most of calls or name spreads to take a position on additional upside, whereas bears can use places or put spreads to take a position on the features petering out and MRK rolling over.

For these trying to be taught extra about choices, contemplate visiting the eToro Academy.

Disclaimer:

Please notice that as a result of market volatility, among the costs could have already been reached and situations performed out.