Victoria d’Este

Revealed: February 06, 2025 at 8:20 am Up to date: February 06, 2025 at 8:20 am

Edited and fact-checked:

February 06, 2025 at 8:20 am

In Transient

Bybit’s monetary penalty of ₹9.27 crore has sparked debate on compliance within the cryptocurrency market, highlighting regulatory points confronted by Indian exchanges and international implications.

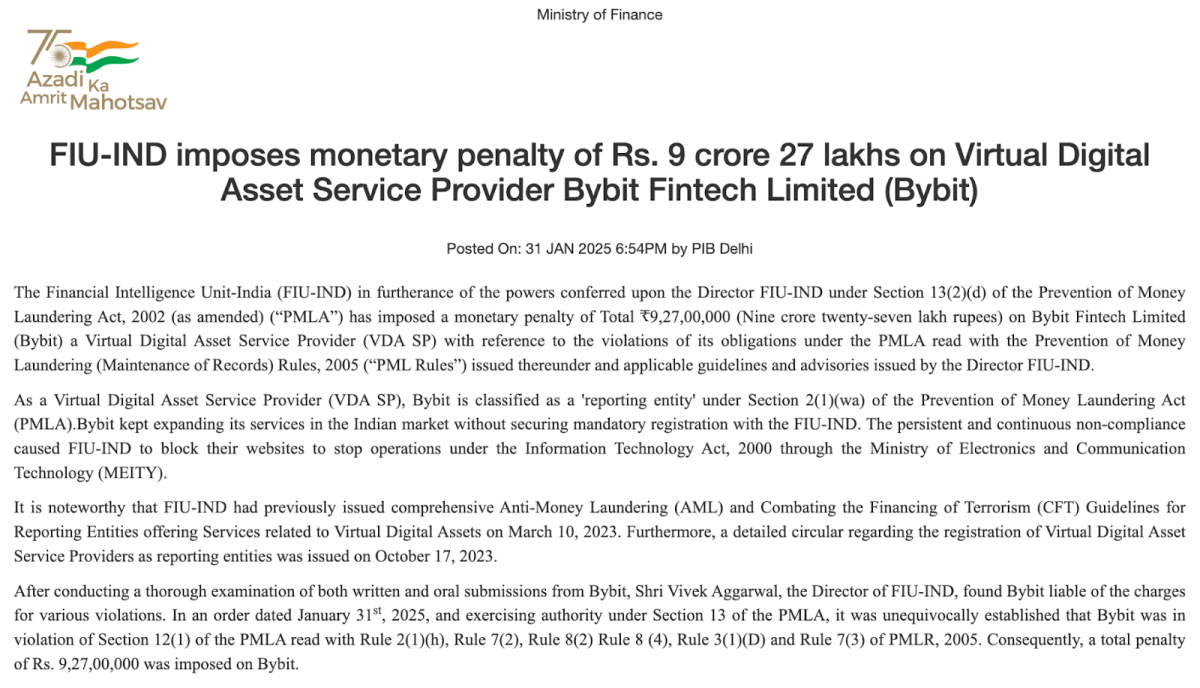

The current monetary penalty issued on Bybit by India’s Monetary Intelligence Unit (FIU-IND) has prompted widespread debate about compliance within the fast-changing cryptocurrency market. Bybit acquired a penalty of ₹9.27 crore (roughly $1.06 million) for violating the Prevention of Cash Laundering Act (PMLA) and associated legal guidelines. This episode not solely underscores the regulatory points that cryptocurrency exchanges confront in India, but it surely additionally has far-reaching ramifications for the worldwide crypto sector.

Photograph: Ministry of Finance

Overview of the Regulatory Framework

The PMLA, applied in 2002, seeks to forestall cash laundering and assure that monetary establishments adhere to excessive compliance requirements. Below this laws, Digital Digital Asset Service Suppliers (VDASPs) resembling Bybit are outlined as ‘reporting entities’ and should register with FIU-IND. The newest steps in opposition to Bybit display the Indian authorities’s willpower to implement compliance on cryptocurrency platforms.

In March 2023, the FIU-IND introduced full suggestions for reporting companies coping with digital digital belongings, highlighting the significance of robust anti-money laundering (AML) and counter-terrorist financing (CFT) procedures. These ideas had been strengthened by a round issued in October 2023, which mandated VDASP registration. Bybit’s ongoing actions with out gaining this registration resulted within the implementation of the punishment and subsequent shutdown of its web sites beneath the Data Know-how Act.

Bybit Operations in India

Bybit, one of many world’s largest cryptocurrency exchanges, has been actively rising its providers in India regardless of an absence of governmental license. This improvement consists of offering a various selection of buying and selling alternate options and monetary items, which drew a big consumer base. Nevertheless, as regulatory strain grew, Bybit discovered itself at a crossroads.

The FIU-IND’s investigation indicated that Bybit didn’t adjust to quite a few vital necessities of the PMLA and its accompanying tips. Particularly, infractions had been discovered in lots of areas of the PMLA and the Prevention of Cash Laundering (Upkeep of Data) Guidelines, 2005. The outcomes prompted FIU-IND to take fast motion in opposition to Bybit, which resulted in an enormous positive.

Implications of Non-Compliance

The implications of noncompliance are extreme for crypto exchanges working in India. The suspension of Bybit’s web sites primarily terminated its actions within the nation, affecting each the platform and its customers. Present prospects had been allowed to withdraw money, however they might not interact in new transactions or make the most of different providers. This interruption demonstrates how regulatory frameworks might straight affect operational capabilities within the cryptocurrency financial system.

Moreover, Bybit’s downside isn’t distinctive; different outstanding exchanges, like Binance and KuCoin, have confronted comparable regulatory procedures for noncompliance with Indian laws. This development signifies a better crackdown on crypto platforms that don’t adjust to native laws.

Bybit Response and Future Prospects

In mild of those modifications, Bybit has made initiatives to enhance its compliance file. The alternate has legally registered with FIU-IND and is now in search of a Digital Digital Asset Service Supplier (VDASP) license. This utility process started on June 26, 2024, reflecting Bybit’s proactive try and adjust to regulatory requirements.

Vikas Gupta, Bybit’s nationwide supervisor for India, expressed confidence in buying full operational licensing within the close to future. This comment exhibits a need to collaborate carefully with Indian officers to repair compliance points and restart common operations.

Regardless of substantial hurdles, together with service suspensions and public doubt about its compliance standing, Bybit is dedicated to negotiating India’s sophisticated regulatory framework. The alternate’s makes an attempt to work together with regulatory organizations mirror a recognition of the worth of compliance in establishing confidence within the crypto ecosystem.

India’s Regulatory Panorama

India has at all times taken a cautious strategy to cryptocurrency regulation, with robust procedures in place to forestall prison exercise utilizing digital belongings. Monetary regulators have elevated their surveillance of cryptocurrencies resulting from their perceived use in cash laundering and terrorism funding.

Nevertheless, there are indications that India’s perspective on cryptocurrencies might shift in response to international developments and inside financial elements. Current conversations amongst politicians point out a readiness to rethink present restrictions and maybe create a extra conducive local weather for cryptocurrency innovation.

As nations all through the world embrace extra inclusive insurance policies relating to cryptocurrencies, India might discover itself caught between stringent regulatory management and growing an environment conducive to technological progress.

The $1 million positive issued on Bybit is reminder of the importance of compliance within the cryptocurrency enterprise. As authorities globally tighten their grip on digital asset platforms, exchanges should prioritize compliance with native legal guidelines to danger harsh penalties and operational interruptions.

Bybit’s expertise demonstrates each the hurdles that VDASPs confront when negotiating sophisticated regulatory regimes and the chance for good change through proactive interplay with authorities. Since India refines its strategy to cryptocurrency regulation, exchanges resembling Bybit might want to alter shortly whereas remaining compliant with rising necessities.

This occasion highlights a watershed second for Bybit and India’s cryptocurrency market, as gamers search clarification regardless of ongoing legislative modifications. The long run success of crypto exchanges can be closely reliant on their skill to adjust to regulatory obligations whereas preserving consumer confidence in an more and more regulated panorama.

Disclaimer

According to the Belief Venture tips, please notice that the data offered on this web page isn’t meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. You will need to solely make investments what you may afford to lose and to hunt unbiased monetary recommendation in case you have any doubts. For additional data, we propose referring to the phrases and circumstances in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Writer

Victoria is a author on quite a lot of know-how matters together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to write down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of know-how matters together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to write down insightful articles for the broader viewers.