Victoria d’Este

Revealed: September 08, 2025 at 11:51 am Up to date: September 08, 2025 at 11:51 am

Edited and fact-checked:

September 08, 2025 at 11:51 am

In Transient

The market is unsure, with Bitcoin, Ethereum, and Toncoin transferring independently, however their mixed temper is marked by hesitation, evident in candles, indicators, and information circulation.

So right here we’re, one other Monday, staring on the charts and asking the identical outdated query: is the market about to get up, or are we in for an additional week of sideways grind? The reply, as all the time, appears to be “each” — as a result of whereas Bitcoin, Ethereum, and Toncoin have all been transferring in their very own lanes, the temper tying them collectively is hesitation. You possibly can really feel it within the candles, the symptoms, even the information circulation. Let’s stroll by way of it.

Bitcoin (BTC)

Bitcoin has been circling in a decent field between $109K and $113K all week, nudging the highest a few instances however by no means with actual conviction. The 4-hour chart reveals the 9-period MA mendacity near-flat, whereas RSI hovers simply above impartial within the low 50s. Mainly, this can be a market pausing. And that is smart if you have a look at the information that’s been tugging it in reverse instructions.

BTC/USD 4H Chart, Coinbase. Supply: TradingView

The primary shove got here from gold. Late August noticed the metallic rip to new document highs, and that stole among the “laborious asset” glow from Bitcoin proper when it might least afford it. The timing was brutal — BTC was already leaning heavy, and immediately its function as digital gold was being overshadowed by the true factor.

XAU/USD every day worth chart. Supply: TradingView

Then the whales weighed in. CryptoQuant knowledge confirmed over 115,000 BTC dumped in August, the biggest sell-off since mid-2022. That’s greater than $12B price of provide urgent down on worth. In the event you’ve been questioning why each rally try fizzles, there’s your reply.

Bitcoin whales have been offloading. Supply: CryptoQuant

Additionally, mining added its personal twist to the entire drama. Issue hit one other all-time excessive on Friday, reflecting the long-term safety of the community but in addition reminding merchants that miners nonetheless must promote to cowl prices. It’s bullish for fundamentals, however within the brief run it’s yet another supply of circulation into the market.

Bitcoin mining issue climbs to a brand new all-time excessive. Supply: CryptoQuant

On the flip aspect, establishments stored the religion. Spot ETFs noticed patches of inflows by way of the week, reversing a few of August’s bleed. Public firms now maintain greater than 1M BTC — that’s over 5% of whole provide locked away on steadiness sheets.

Metaplanet added one other 1,000 cash, El Salvador topped up as nicely, and Tether went out of its option to say it hasn’t been promoting a single satoshi, nonetheless plowing income into Bitcoin, gold, and even actual property.

Put all of that collectively and also you’ll get the explanations for the stalemate we’re seeing on the chart. The market is being pulled in each instructions directly — heavy provide from whales and miners, regular accumulation from establishments and treasuries. No marvel the candles look confused.

For merchants, the degrees are these: $113K, as soon as cleared with quantity, will open the trail opens towards $116K–$118K. But when $109K is misplaced, we’ll virtually definitely retest that $106K low from August. Till then, although BTC is simply pacing its cage, ready for one thing sufficiently big to interrupt the impasse.

Ethereum (ETH)

Imagine it or not, Ethereum has additionally been caught in a slim $4,250–$4,350 band all week. The 9-period MA has flattened right into a straight line, whereas RSI hangs within the mid-40s, neither sizzling nor chilly. On the floor, ETH appears prefer it’s simply catching its breath after August’s document highs. However as with Bitcoin, the currents beneath are pulling in numerous instructions.

ETH/USD 4H Chart, Coinbase. Supply: TradingView

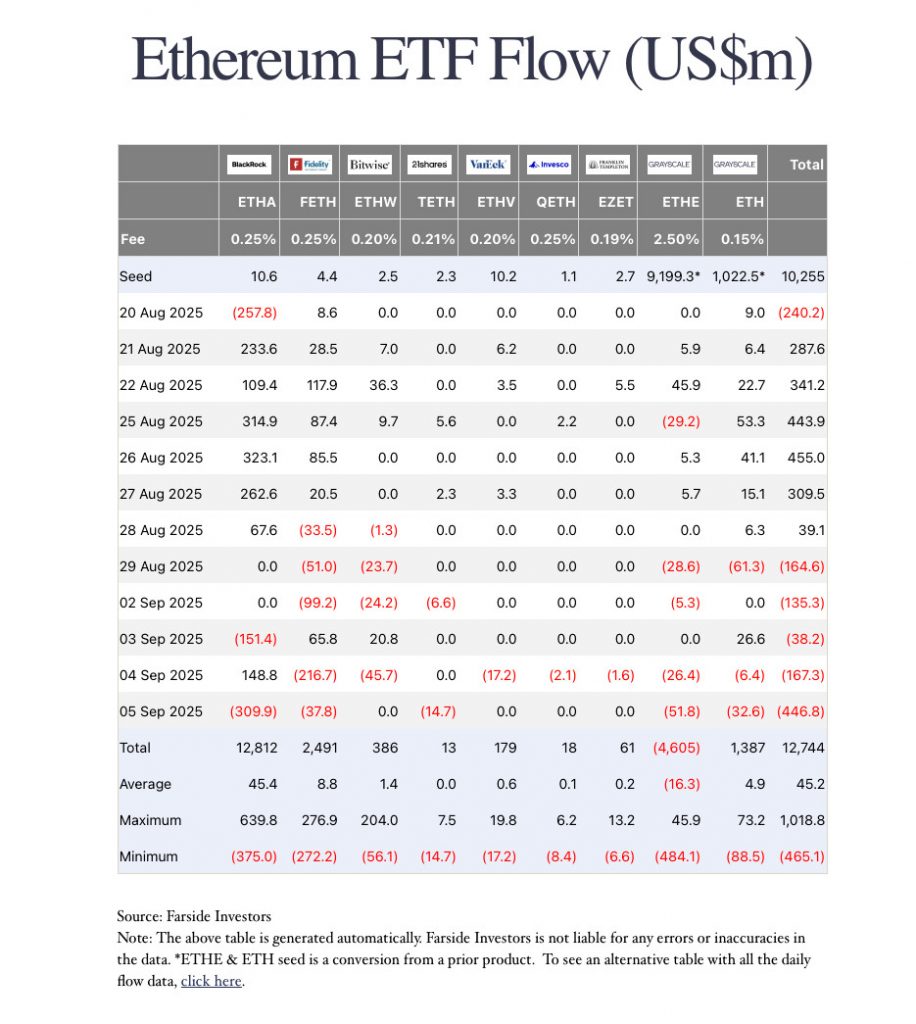

Let’s begin with the bearish aspect. U.S. spot Ether ETFs bled closely, practically $800M in outflows over 4 buying and selling days. That’s actual cash leaving the asset, and it tells you that at the very least among the institutional crowd determined the post-ATH pullback wasn’t price driving out. It’s laborious to construct bullish momentum when that form of weight is urgent down.

Supply: Farside Buyers

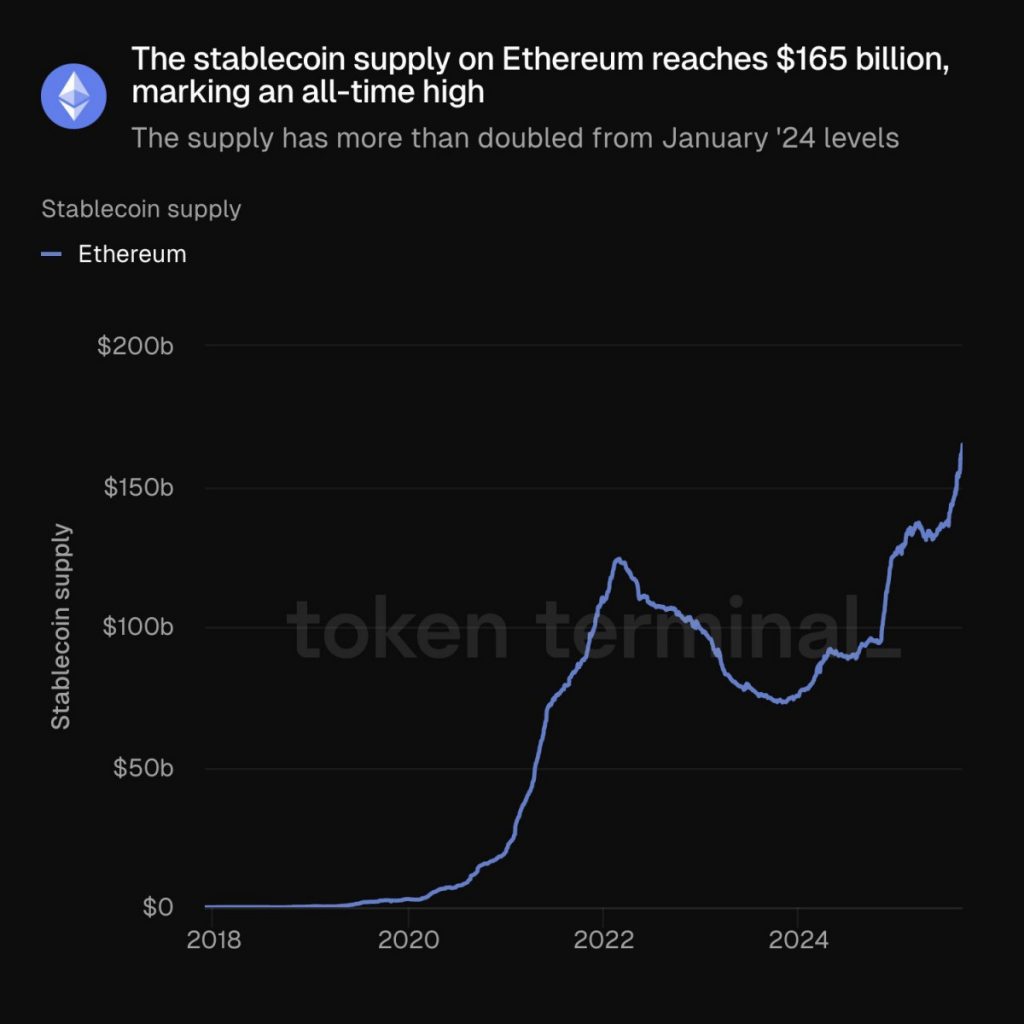

However on-chain knowledge tells a barely completely different story. In line with Token Terminal, Ethereum added virtually $5B in stablecoins final week alone, pushing whole provide to a document $165B. That form of liquidity often indicators capital parking contained in the ecosystem, ready to maneuver. Alternate balances have stored draining too, hitting multi-year lows. So, provide is tightening, even whereas ETFs promote.

Stablecoin provide on Ethereum surges. Supply: Token Terminal

And one other piece of the puzzle is, after all, whales. They’ve quietly elevated holdings by round 14% since April’s low, and accumulation has continued even throughout this sideways chop.

In our opinion, if $4,200 is held, then ETH can nonetheless body this as wholesome consolidation earlier than one other leg larger. Reclaiming $4,450–$4,500 with RSI leaning towards 60 can be the makings of a breakout towards $4,700. But when $4,200 provides manner, the August low at $4,060 is nearly sure to get a retest.

For now, identical to Bitcoin, Ethereum is ready for a set off.

Toncoin (TON)

After which there’s Toncoin, which has been the heaviest of our trio this week. Week after week it’s leaned decrease, and now worth is balanced proper on that mid-June low round $3.05. The value hasn’t cracked it but, however each check feels heavier. Technically, the chart says indecision with a bearish lean — candles urgent the ground, RSI dangling round 50%, momentum fading, and no bounce with actual conviction in sight. However the paradox is that in the event you solely appeared on the headlines, you’d swear TON needs to be flying.

TON/USD 4H Chart. Supply: TradingView

As it’s possible you’ll bear in mind, final week Robinhood added TON to its lineup, which is a critical stamp of legitimacy for retail publicity.

This previous week we additionally had some heavyweight information: AlphaTON launched a $100M digital asset treasury technique to purchase TON outright. Anthony Scaramucci himself signed on as an advisor. That’s some Wall Road pedigree now favoring TON.

Supply: GlobeNewswire

In the meantime, the official TON account dropped a teaser: one of many world’s “most trusted platforms” is about to hitch the ecosystem. Hypothesis has zeroed in on OpenSea, which, if true, can be a major bridge between TON and the broader NFT market.

So why hasn’t any of this moved worth? In all probability as a result of the gravity is coming from elsewhere. With Bitcoin caught in its personal vary and ETH treading water, TON hasn’t been in a position to break away. The ecosystem can gentle fires, however on this market, broader danger sentiment units the ceiling.

That leaves merchants watching one quantity: $3.05. If it holds, TON has room to rebound towards $3.20–$3.35, particularly if the OpenSea rumor materializes. If it cracks, the slide into the high-$2s appears inevitable.

For now, TON is the paradox coin: headlines buzzing, fundamentals deepening, however worth continues to be wanting heavy.

Disclaimer

In keeping with the Belief Undertaking tips, please be aware that the knowledge supplied on this web page isn’t meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. It is very important solely make investments what you may afford to lose and to hunt unbiased monetary recommendation when you have any doubts. For additional data, we advise referring to the phrases and circumstances in addition to the assistance and help pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Writer

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to put in writing insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of expertise subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to put in writing insightful articles for the broader viewers.