Alisa Davidson

Printed: Could 05, 2025 at 10:30 am Up to date: Could 05, 2025 at 11:22 am

Edited and fact-checked:

Could 05, 2025 at 10:30 am

In Temporary

This previous week in crypto felt calm however coiled, with Bitcoin and Ethereum consolidating in tight ranges whereas exhibiting refined indicators of energy, and Toncoin lagging regardless of main ecosystem developments.

Generally the market feels too calm. Not in a boring means, however in that quiet, coiled form of means the place nothing’s exploding, but nothing’s slipping both. You get tight ranges, small reactions to huge information, and simply sufficient motion to maintain everybody guessing. That’s just about what this previous week regarded like. And if you dig into the charts and the headlines, just a few patterns begin to stand out. Let’s get into it.

Bitcoin (BTC)

Bitcoin didn’t transfer a lot this week on the floor – largely caught between ~$93K and ~$97K. However that doesn’t imply nothing occurred. When GDP information got here in weaker than anticipated, we noticed a fast dip beneath $93K. It didn’t final although – patrons confirmed up, value recovered, and BTC settled proper again into the identical tight vary.

BTC/USDT 4H Chart, Coinbase. Supply: TradingView

If you happen to’re watching the 4h chart, the construction’s been clear. Worth revered the 50-period SMA all week. It bounced off that degree greater than as soon as and by no means actually misplaced it. RSI briefly dropped into the low 40s, however turned again up quick – not what you’d count on if sellers had been in management. It’s the form of gradual buildup you usually get earlier than a much bigger transfer.

So what’s holding it supported? ETF inflows are nonetheless regular, and there’s been a shift in price lower expectations – particularly after the comfortable JOLTS information and labor numbers. For now, that’s serving to to carry the ground.

US Shopper Confidence (left) vs. Complete non-farm US job openings (proper). Supply: TradingView/Cointelegraph

Two narratives additionally gave Bitcoin some carry. First, U.S. nationwide safety voices – together with folks linked to the CIA – overtly mentioned Bitcoin in a geopolitical context (Controversial, certain, however nonetheless notable).

Podcast host and investor Anthony Pompliano (left) and Deputy CIA director Michael Ellis (proper). Supply: Anthony Pompliano

Second, Michael Saylor’s agency hinted at one other spherical of BTC purchases after earnings. Nothing shocking, but it surely reinforces the concept huge gamers are nonetheless accumulating.

Michael Saylor

Technically, ~$95K appears like a stress level proper now. Worth retains returning there, however hasn’t damaged by way of but.

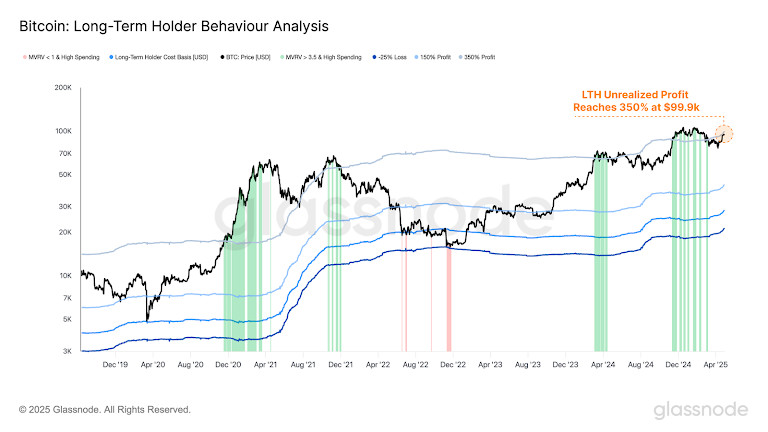

Souce: Glassnode

And regardless of unrealized income sitting round 350% (per Glassnode’s latest report) traditionally the place folks begin fascinated with taking positive aspects – we’re not seeing actual promoting stress. And to date, it’s nonetheless a wait-and-see kind of setup.

Ethereum (ETH)

ETH didn’t transfer a lot this week – however that’s precisely what made it attention-grabbing. Worth held between roughly $1,770 and $1,870 on the 4h chart, forming a good, sideways vary. It saved driving the 50-period SMA, and in contrast to BTC, by no means convincingly dipped beneath it. That form of relative stability doesn’t make headlines, however technically, it’s telling. RSI spent a lot of the week drifting within the low-to-mid 50s – not bullish, not bearish both. And generally, that’s the sign.

ETH/USDT 4H Chart, Coinbase. Supply: TradingView

What stands out is that ETH didn’t fall behind. For weeks, it’s been lagging BTC – each in value motion and in sentiment. However now the ETH/BTC pair is exhibiting indicators of bottoming, and we’re beginning to hear “undervalued” once more in analyst notes. It’s not hype – it’s the construction. We’ve bought a flattening RSI, clear help holds, and a chart that’s been coiling for weeks. The longer it coils with out breaking down, the extra gasoline it builds.

In the meantime, the basics quietly improved. The Pectra improve is now on the calendar (set for Could 7). Builders proposed new ERC requirements centered on multichain compatibility. And Vitalik popped up once more, pushing for less complicated Ethereum design that’s simpler to construct on.

Vitalik Buterin

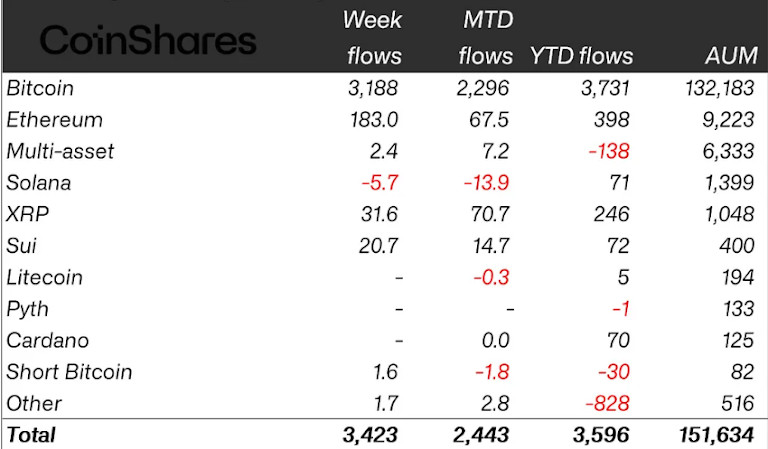

We’re additionally beginning to see Ethereum present up in locations it’s been lacking from these days. ETP flows, for example – these have began to incorporate extra ETH publicity once more. It’s not a wave, however the tilt is noticeable. A number of institutional funds that had backed off earlier within the cycle are actually quietly reallocating again into ETH. Nothing dramatic, however sufficient to counsel the sentiment is shifting beneath the floor.

Flows by asset (in hundreds of thousands of US {dollars}). Supply: CoinShares

And that shift issues. As a result of this wasn’t a breakout week – ETH didn’t rip by way of resistance or lead the cost. But it surely additionally didn’t roll over. If the present vary finally ends up breaking increased, we would look again at this stretch as the purpose the place Ethereum stopped trailing and began stabilizing. Positive, it’s not main but. However on the chart, at the least, it’s not lagging behind.

Toncoin (TON)

In the meantime, TON has been drifting – to not say collapsing, however clearly underperforming. The 4h chart reveals a clear rejection from the $3.40 a rea and a gradual decline again to the decrease certain of its latest vary, round $3.05. What’s key right here is that the 50-period SMA flipped to resistance midweek, and the RSI hasn’t recovered – it’s been sliding beneath 50 for days, now touching 36. That implies sellers stay in management, even when the tempo is gradual. There’s no capitulation, but additionally no signal of patrons stepping in with conviction.

TON/USD 4H Chart. Supply: TradingView

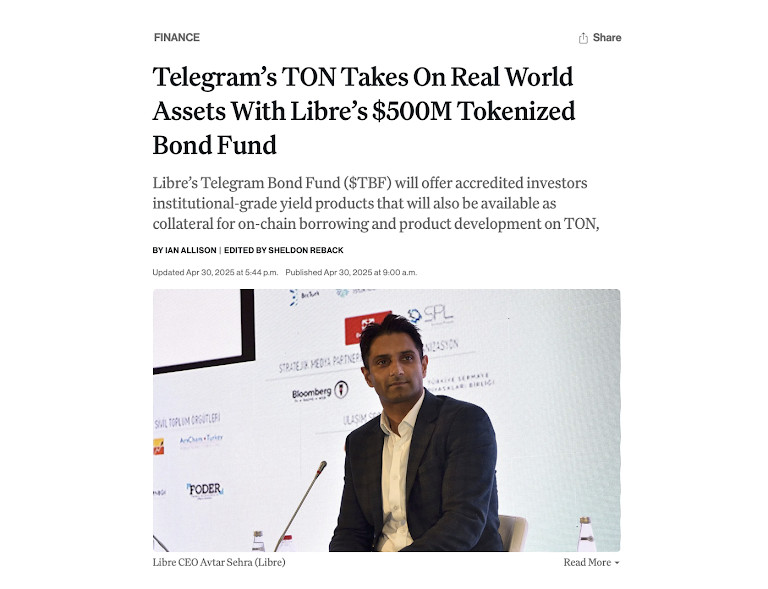

What makes this underperformance extra attention-grabbing is how a lot elementary information dropped this week. For one, Libre introduced a $500M tokenized bond fund on TON – and that’s not small speak. It means real-world property (RWAs), linked to Telegram itself, are beginning to reside on this chain.

Supply: CoinDesk

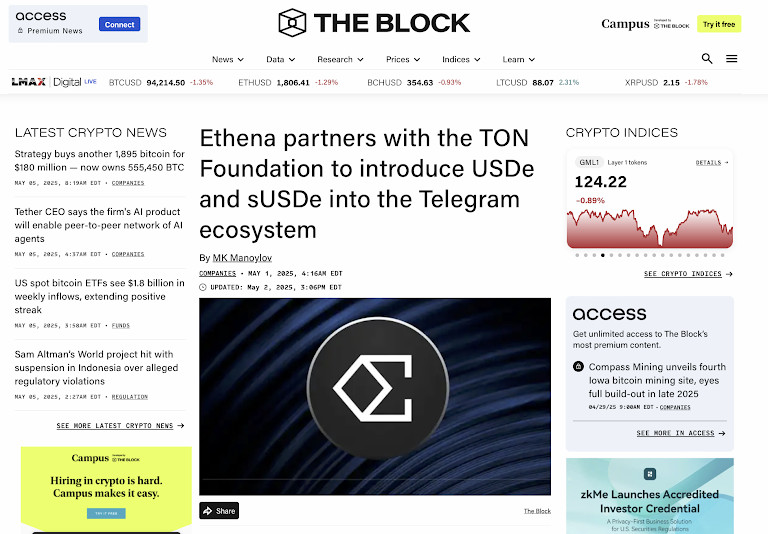

On the similar time, Broxus rolled out TON Manufacturing facility, a scaling platform claiming as much as 35K transactions per second – which alerts severe L2 infrastructure ambitions. There’s additionally the Ethena integration: sUSDe and USDe stablecoins are being woven into Telegram’s ecosystem, proper alongside TON.

Supply: The Block

Imagine it or not, the worth hasn’t responded to these information but. And that tells us just a few issues. First, this week’s developments are nonetheless largely infrastructural. They don’t have an effect on token velocity or demand instantly – they’re slightly setup steps. Second, TON nonetheless isn’t a part of the ETF/macro narrative driving BTC and ETH. So whereas fundamentals are bettering, there doesn’t appear to be any spillover bid.

That doesn’t imply the updates don’t matter. They really reinforce the long-term case: if Telegram continues to double down on TON-native infrastructure and stablecoins, that positions the community as a consumer-facing crypto layer. However for now, that’s a positioning story – not a value driver. Till flows catch up or the chart reveals a reversal (say, reclaiming the 50 SMA or RSI breaking again above 50), TON will stay a laggard, technically talking.

So How Does the Market Really feel Proper Now?

It appears like crypto’s on the brink of transfer – not exploding, however shifting its weight ahead. BTC’s compressing beneath $97K, ETH’s discovering its footing, and TON’s making an attempt to carry on regardless of the drag. For now, the charts say: keep alert, keep affected person. The stress’s constructing – and if it releases, it gained’t be quiet.

Disclaimer

Consistent with the Belief Mission tips, please observe that the data offered on this web page is just not supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. It is very important solely make investments what you’ll be able to afford to lose and to hunt impartial monetary recommendation when you’ve got any doubts. For additional data, we advise referring to the phrases and circumstances in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Creator

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa Davidson

Alisa, a devoted journalist on the MPost, focuses on cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising developments and applied sciences, she delivers complete protection to tell and interact readers within the ever-evolving panorama of digital finance.