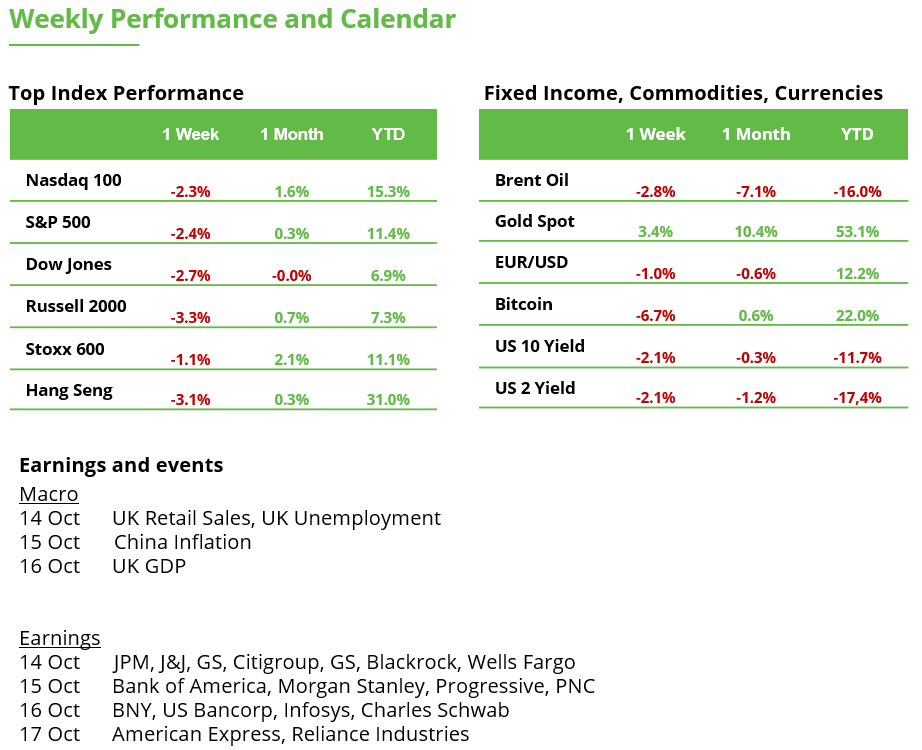

Analyst Weekly, October 13, 2025

China Tensions Rising Once more

What Occurred: Beijing expanded export restrictions on rare-earth supplies crucial to AI and semiconductor manufacturing, launched an antitrust probe into Qualcomm, and launched new port charges forward of US measures on giant Chinese language vessels (efficient Oct. 14). In response, the US President threatened tariffs of as much as 100% on Chinese language imports and signaled extra export controls on delicate applied sciences.

Funding Takeaway: In our view, latest actions level to renewed friction somewhat than collapse within the US–China commerce dialogue. Whereas excessive tariffs might in the end weigh on tariff revenues and holiday-season provide, each governments seem targeted on strategic positioning somewhat than outright disengagement. Extra measures on plastics, chips, and doubtlessly energy-linked commerce (China’s oil dealings with Russia) might observe.

Brief time period: Rising coverage uncertainty could hold export-heavy and China-exposed sectors underneath stress ({hardware}, autos, transport).

Medium time period: US high quality and domestically oriented equities stay higher positioned amid a extra self-sufficient industrial coverage.

Long run: Industrial self-sufficiency, semiconductor independence, and supply-chain resilience stay central themes.

Coverage-driven Industrial Revival

Washington’s “sovereign wealth” like investments, focusing on US Metal, Intel, MP Supplies, Lithium Americas, and Trilogy Metals, sign a structural pivot towards home manufacturing of crucial supplies and chips.

Funding Takeaway: Lengthy-duration help for US metals, rare-earth, and semiconductor supply-chain names as these corporations turn out to be central to nationwide security-linked manufacturing. Firms impacted:

US Metal (X) – metal capability and reshoring narrative.

MP Supplies (MP), Lithium Americas (LAC), Trilogy Metals (TMET) – crucial minerals, uncommon earths, and EV-supply inputs.

Intel (INTC) – CHIPS Act capital infusion and geopolitical desire over Asia-based friends.

Earnings Preview: Main S&P 500 Firms Reporting October 13–17, 2025

The week of October 13, 2025 marks a key kickoff to the third-quarter 2025 earnings season. A slew of main US corporations, spanning banking, healthcare, shopper, and industrial sectors, are set to report outcomes. Buyers shall be dissecting these studies for clues on financial well being and company-specific tendencies.

JPMorgan Chase & Co. (JPM): A “rebound in funding banking” is predicted to carry earnings. Buyers will deal with internet curiosity earnings (NII) which has been boosted by greater rates of interest and whether or not administration raises its full-year NII steerage after robust positive factors

Wells Fargo & Co. (WFC): Buyers will search for any change to NII steerage given fee strikes and deposit tendencies in Q3. The road will deal with any commentary on decreasing expense ranges.

The Goldman Sachs Group (GS): Goldman’s backlog of offers and commentary on the M&A outlook shall be key; traders need to know if the Q3 surge is sustainable or “one-off.”

BlackRock Inc. (BLK): Fund flows are the lifeblood of BlackRock’s development. Any commentary on investor preferences (e.g. shifting into bond funds given greater yields) shall be beneficial.

Citigroup Inc. (C): Citi’s multi-year revamp means it’s incurring costs to streamline administration layers and divest sure items. Buyers are laser-focused on expense management: will the Q3 outcomes present effectivity bettering?

Financial institution of America Corp. (BAC): Like friends, BofA faces inflationary pressures on prices (wages, tech spend). Any point out of effectivity enhancements or areas of value self-discipline (e.g. department community optimization) shall be welcomed.

PNC Monetary Companies (PNC): Regional banks in 2025 have confronted stress from prospects reallocating deposits to higher-yielding choices (so-called “deposit beta” stress). Buyers will watch how PNC’s deposit balances and prices fared in Q3. Credit score high quality is one other focus.

Johnson & Johnson (JNJ): Buyers will deal with administration’s commentary across the firm’s pharmaceutical pipeline momentum and on sustained MedTech development.

Progressive Corp. (PGR): Insurer more likely to point out that it’s going to keep pricing self-discipline even after gaining over some extent of auto insurance coverage market share, and can carefully monitor claims value tendencies (like auto restore inflation and disaster losses) to maintain its superior underwriting efficiency.

United Airways (UAL): Buyers shall be tuned into the service’s value steerage; United expects a tailwind from decrease gasoline costs serving to Q3 outcomes.

American Specific (AXP): Buyers will deal with whether or not American Specific can maintain robust premium card spending and mortgage development whereas sustaining credit score high quality.

Crypto Obtained Crunched

Final Friday, crypto confronted one in all its ugliest hours ever. Bitcoin plunged 15% in about an hour, Ethereum slid 20%, and a few altcoins received halved. A record-breaking liquidation occasion that noticed almost $20 billion in leveraged positions worn out in simply at some point.

What sparked it:

Tariff tensions between the US and China lit the fuse, however the explosion got here from inside. The market was over-leveraged and paper-thin on liquidity.

The way it unraveled:

Perpetual contracts, the go-to weapon for merchants, turned the set off. As leveraged longs received liquidated, automated promote orders snowballed, wiping out over half of worldwide open curiosity in underneath two hours.

The massive image:

It’s noteworthy that regardless of the dimensions of the occasion, Bitcoin has already recovered to round $115K on Sunday, reflecting its rising resilience and market maturity.

Takeaway for traders:

Avoid devices with out actual depth.

Choose direct, clear, and custodied publicity.

Deal with crypto as infrastructure, not a fast gamble.

SPDR S&P Financial institution ETF Defends Brief-term Help Zone

The SPDR S&P Financial institution ETF slipped by almost 1% final week, extending its dropping streak to a 3rd consecutive week. Nonetheless, the bulls managed to defend the honest worth hole between 56.41 and 57.36, a zone that emerged from the sharp rally in August and now serves as a key help space.

So long as this vary is just not sustainably damaged to the draw back, the uptrend construction, characterised by greater highs and better lows in latest months, stays intact. From a technical perspective, this means {that a} continuation of the development is the probably state of affairs.

For the uptrend to renew, nevertheless, patrons might want to overcome the honest worth hole between 60.93 and 61.38, an vital resistance zone the place the ETF has already failed a number of instances. The upcoming earnings season will doubtless decide whether or not a brand new breakout try is on the horizon or if the help zone shall be examined once more.

SPDR S&P Financial institution ETF, weekly chart. Supply: eToro

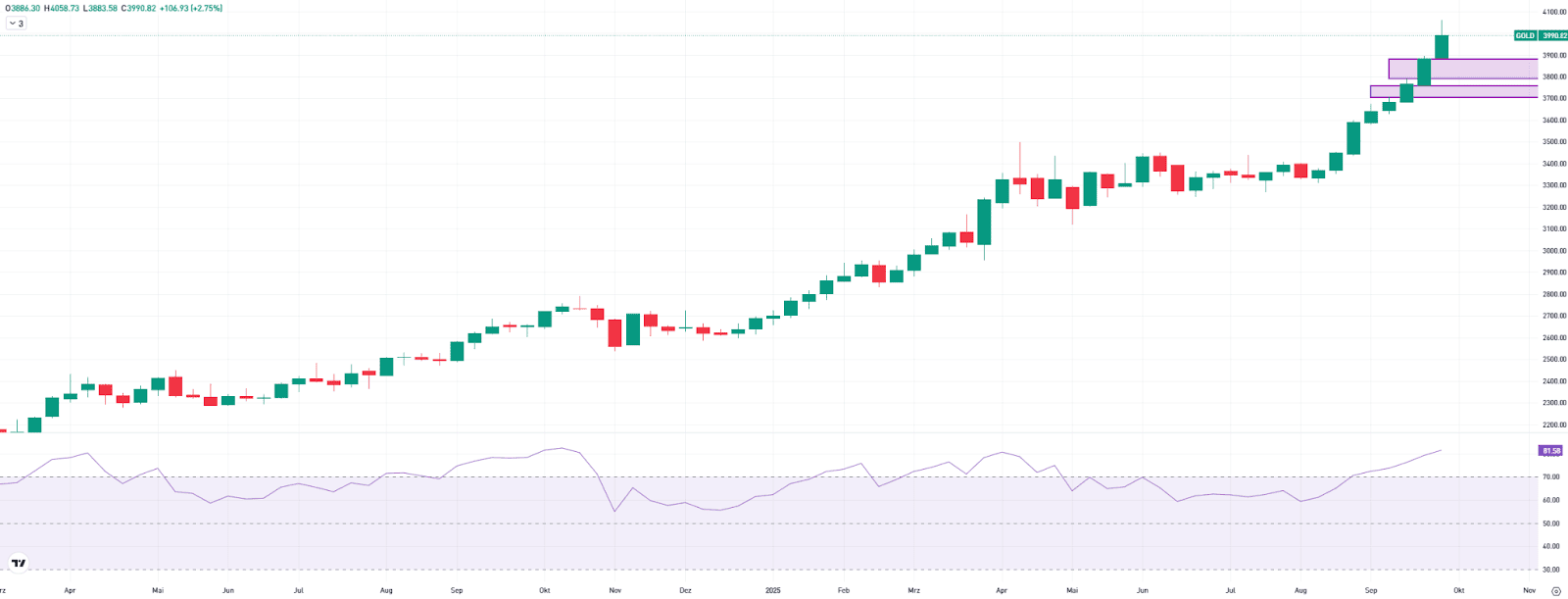

Gold: Document Excessive and Overheating on the Identical Time?

Gold rose by 2.75% final week, marking a brand new all-time excessive. At one level, the value even climbed above $4,000, leaving little doubt in regards to the energy of the uptrend.

Nonetheless, the short-term upward impulse now seems to be enormously overstretched. It was already the eighth consecutive week of positive factors, and the RSI, at over 81, is flashing clear indicators of overheating. Because the starting of the yr, gold has gained greater than 50%.

An overbought market doesn’t essentially imply {that a} correction is imminent. Nonetheless, a pullback could be wholesome to ease the overheated state of affairs. Such consolidation phases can final for a number of weeks and are sometimes accompanied by the RSI dropping again under the 70 stage.

The primary key help zones are the honest worth gaps between $3,790 and $3,883 in addition to $3,707 and $3,762. Buyers ought to carefully monitor how the value behaves in these areas if the gold worth experiences a short-term pullback.

Gold, weekly chart. Supply: eToro

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding goals or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.