Entrance-running is among the most debated and ethically difficult points in crypto buying and selling. In reality, former Binance CEO Changpeng Zhao (CZ) had not too long ago voiced considerations about front-running on DEXs. Whereas the time period originates from conventional finance, the place it’s thought-about unlawful, front-running in crypto has discovered new life on the blockchain in additional advanced and automatic types. This text breaks down what front-running in crypto means, the way it works within the crypto house, and easy methods to keep away from front-running as a dealer.

What Is Entrance-Working? (Conventional Finance vs. Crypto)

In conventional finance, front-running happens when a dealer makes use of data of a consumer’s upcoming giant commerce to position their very own order forward of it, taking advantage of the anticipated worth shift. Since this entails insider info and breaches fiduciary responsibility, it’s unlawful in most jurisdictions.

However is front-running the identical as insider buying and selling? Not precisely. Whereas each contain unethical behaviour, front-running in crypto typically exploits blockchain transparency. Anybody can view pending transactions within the mempool (reminiscence pool), the place transactions wait earlier than being confirmed. Malicious actors, together with miners, validators, or bots, scan this mempool and submit transactions with larger charges to leap the queue and revenue from worth actions they know are about to happen.

How Does Entrance-Working Work in Crypto?

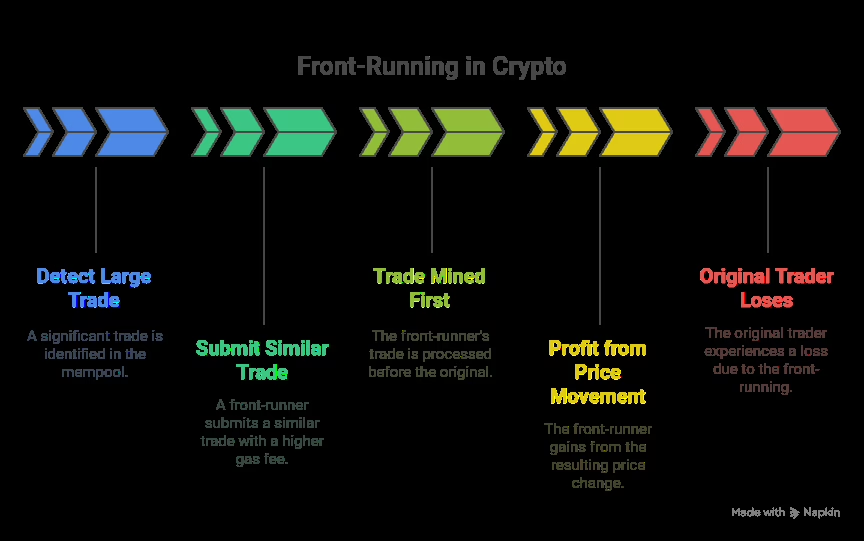

Blockchain transparency is a double-edged sword. Whereas it ensures belief and auditability, it additionally makes each pending transaction seen earlier than it’s confirmed. Right here’s how front-running works in crypto:

A big commerce is detected within the mempool.

A front-runner submits the same commerce with the next gasoline price to make sure it’s mined or validated first.

The front-runner income from the ensuing worth motion, typically on the expense of the unique dealer.

That is particularly frequent on DEXs the place there aren’t any centralized intermediaries to forestall such ways.

MEV in Entrance-Working

Most Extractable Worth (MEV) refers back to the extra revenue that validators, or beforehand, miners can earn by manipulating the order of transactions inside a block. This manipulation consists of reordering, inserting, and even excluding transactions to maximise beneficial properties. Initially known as Miner Extractable Worth, the time period has advanced with the rise of proof-of-stake (PoS) methods like Ethereum’s, the place block producers are not miners however validators.

It’s a high-stakes phenomenon that exhibits how revenue incentives can distort truthful transaction ordering.

The MEV ecosystem is a fancy area involving a number of gamers. Validators suggest blocks and resolve the transaction order. Working alongside them are “searchers” (people or groups that develop subtle algorithms to scan public mempools for worthwhile MEV alternatives.) These searchers typically deploy automated bots to behave on their findings in real-time.

These MEV bots function with outstanding pace and precision, executing methods that exploit worth discrepancies, arbitrage alternatives, and huge DEX transactions. In lots of instances, they aim so-called “whale” trades or high-volume swaps the place the potential for front-running or sandwich assaults is most profitable. Among the most superior MEV bots have been reported to earn tens and even a whole bunch of hundreds of {dollars} every month.

Collectively, validators, searchers, and bots type an intricate worth chain—one which showcases the innovation and equally exposes the dangers related to blockchain transparency.

Widespread Varieties of Entrance-Working Assaults

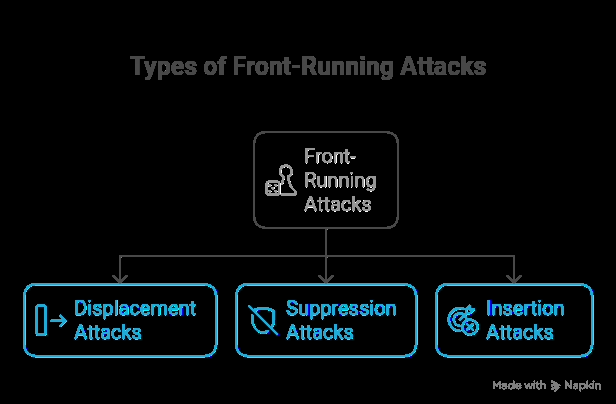

1. Displacement assaults

The attacker observes a pending transaction and submits a competing one with the next gasoline price, pushing the unique transaction again in line. The attacker captures the supposed alternative for themselves.

2. Suppression assaults

The front-runner floods the community with high-gas transactions to delay others. This congestion prevents the sufferer’s transaction from being confirmed in time, leading to failed or much less beneficial trades.

3. Insertion assaults (a.ok.a. sandwich assaults)

Among the many most infamous and dangerous types of front-running in crypto is the insertion assault, generally known as a sandwich assault. This tactic entails strategically inserting two trades—one earlier than and one after a sufferer’s transaction—to be able to revenue from the ensuing worth motion.

Right here’s the way it works: A dealer unknowingly submits a big transaction on a decentralized change, say a purchase order for a particular token. A front-runner, usually an MEV bot or subtle dealer, detects the pending transaction within the mempool. The attacker shortly locations a purchase order simply forward of the sufferer’s transaction, which pushes the token’s worth upward. As the unique dealer’s giant purchase order executes, it does so at this now-inflated worth. Then, virtually immediately, the attacker finalizes the assault by inserting a promote order, cashing out on the elevated worth and capturing the distinction as pure revenue.

Right here’s an instance of entrance operating:

Think about a dealer is seeking to purchase a considerable amount of a DeFi token, say 50,000 models of TokenX, which is at the moment buying and selling at $2.00 per token. The MEV bot spots this order within the mempool and races to purchase TokenX first at $2.00. This preliminary buy drives the worth up barely because of the token’s restricted liquidity. The dealer’s giant order then will get stuffed on the new, larger worth, say, $2.05. Instantly afterwards, the bot sells the identical tokens it purchased earlier at $2.05, making a tidy revenue of $0.05 per token, totalling $2,500, all on the expense of the unsuspecting dealer.

These assaults are significantly damaging as a result of they manipulate costs in actual time, harm real customers, and compromise the equity of decentralized markets. Worse nonetheless, since they exploit blockchain transparency and pace relatively than hacking or deception, sandwich assaults (a extra superior model of front-running) are tough to detect and even more durable to forestall with out proactive protecting instruments.

The place Entrance-Working Occurs Most

1. Decentralized exchanges (DEXs)

DEXs are among the many commonest environments for front-running assaults as a result of their open structure and public mempools. When a consumer initiates a commerce on DEX platforms, the transaction enters the mempool earlier than being finalized onchain—giving MEV bots time to research and exploit the commerce. Bots scan for giant trades or arbitrage alternatives, then submit their very own transactions with larger gasoline charges to get processed first, successfully “chopping the road” and profiting off the slippage created by the sufferer’s order.

2. NFT marketplaces with public bidding

Entrance-running additionally happens on NFT platforms, significantly when a high-value bid or itemizing turns into seen earlier than affirmation. Bots or malicious merchants monitor bidding exercise and may shortly outbid or snatch NFTs earlier than the unique purchaser’s transaction is finalized. For instance, if somebody locations a big bid on a uncommon NFT, an attacker may front-run that bid by providing a barely larger worth with a sooner transaction, snagging the asset earlier than the unique purchaser’s order is processed. This undermines truthful market behaviour and erodes belief in NFT platforms.

3. Token launchpads and preliminary coin choices (ICOs)

Token launchpads and ICOs are hotbeds for front-running in crypto, particularly within the first few moments when a brand new token turns into obtainable. Bots are programmed to watch good contracts and mempool exercise to allow them to quickly submit purchase orders with extraordinarily excessive gasoline charges, gaining early entry to newly launched tokens. This typically leads to inflated costs earlier than retail customers actually have a probability to take part. By the point bizarre traders place their trades, the worth could have already spiked considerably, forcing them to purchase at a premium or miss out totally.

Methods to Keep away from Entrance-Working in Crypto

1. Use MEV-resistant instruments

To reduce the danger of front-running and sandwich assaults, think about using MEV-resistant instruments like Flashbots Shield. These instruments supply various transaction submission strategies that bypass the general public mempool—the place malicious bots usually scan for exploitable trades. With Flashbots, customers can ship transaction bundles on to a personal mempool, retaining the small print hidden from MEV bots. This safe route helps you keep away from front-runners on DEX platforms. It ensures that your transactions are executed with out being uncovered to opportunistic methods that might manipulate costs or execution timing.

2. Commerce on non-public or protected DEXs

You may keep away from front-running by utilizing non-public or protected decentralized exchanges like CowSwap and 1inch Fusion implement mechanisms that protect transaction particulars till they’re executed. These platforms act like “darkish swimming pools,” stopping malicious actors from utilizing your commerce knowledge for front-running assaults. By masking your transaction info till it’s too late for others to behave on it, you considerably scale back the danger of manipulation.

3. Set low slippage tolerance

Slippage refers back to the acceptable distinction between the anticipated worth of a commerce and the executed worth. By setting a low slippage tolerance, you restrict how a lot a bot can exploit your transaction by pushing the worth in opposition to you. If a bot tries to govern the market, your commerce will fail relatively than execute at a poor fee, defending you from inflated prices.

4. Break giant trades into smaller batches

Executing a big commerce abruptly alerts your intent to the market, making it simple for bots to focus on and front-run. As an alternative, breaking it into smaller chunks reduces visibility and the probability of triggering a bot’s algorithm. It additionally smooths out the worth affect, guaranteeing your common value stays nearer to market worth.

6. Keep away from buying and selling throughout excessive volatility

Durations of excessive market exercise, akin to throughout information bulletins or main worth swings, entice a swarm of MEV bots seeking to capitalize on chaos. Avoiding trades throughout these risky home windows lowers your possibilities of being front-run, as fewer bots can be monitoring your exercise when issues are calmer. Timing generally is a highly effective defence when navigating unpredictable DeFi waters.

Ultimate Ideas

Entrance-running in crypto is a systemic problem deeply tied to blockchain’s open structure. Whereas the visibility of the mempool fosters transparency, it additionally exposes merchants to exploitation. Understanding how front-running works, recognizing its types, and utilizing obtainable instruments and finest practices may help defend your trades.

Because the DeFi ecosystem matures, we will anticipate larger innovation in MEV mitigation and fairer buying and selling infrastructure. However till then, navigating crypto securely requires consciousness, the precise instruments, and a cautious strategy.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of monetary loss. All the time conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

The publish What’s a Entrance-Working Assault in Crypto? And Methods to Shield Your self appeared first on DeFi Planet.