What’s a privateness coin? This query has turn into more and more related as cryptocurrency customers search for stronger management over monetary visibility, anonymity, and on-chain publicity in a world of rising surveillance. From shielding balances to enabling a very non-public transaction, privacy-focused cryptocurrencies are shaping how individuals take into consideration monetary autonomy in 2026.

On this article, we focus on how privateness cash work at a excessive degree, why demand for them continues to develop, how they differ from clear blockchains, the place they match inside present laws, and what dangers and trade-offs customers ought to perceive earlier than participating with them. Preserve studying to discover how privateness cash are influencing the way forward for digital cash.

What’s a Privateness Coin?

A privateness coin is a class of cryptocurrency constructed to restrict the visibility of transaction knowledge whereas nonetheless working on a public blockchain. It prioritizes consumer management over what data is uncovered, specializing in transaction flows relatively than speculative options or branding narratives. In contrast to clear networks the place pockets balances and transfers may be traced indefinitely, privateness cash are designed to cut back linkability between sender, receiver, and quantities. This design selection explains how privateness cash match into cryptocurrency as a practical response to traceability, compliance strain, and the rising use of blockchain analytics throughout exchanges, governments, and enterprises.

How Privateness Cash Defend Your Identification

Privateness cash defend consumer id by minimizing the quantity of knowledge that may be noticed, linked, or analyzed throughout transactions. As a substitute of counting on account primarily based transparency, they obscure transactional relationships so exterior observers can not reliably join pockets addresses, balances, or exercise patterns to an actual individual. This method reduces publicity to profiling, monitoring, and behavioral evaluation on public ledgers.

These techniques depend on privateness applied sciences past good contracts to realize confidentiality on the protocol degree. Methods akin to ring signatures, stealth addressing, and 0 data proofs are used to masks sender and recipient particulars whereas nonetheless permitting the community to validate transactions. In some instances, ring confidential transactions conceal transferred quantities, making certain that even transaction values can’t be reconstructed or inferred by chain evaluation.

Key Applied sciences Behind Privateness Cash

Crypto privateness cash depend on applied sciences to make sure each non-public transaction stays safe and untraceable. These improvements transcend conventional cryptocurrency mechanisms, providing customers unparalleled anonymity and safety. Listed here are the important thing applied sciences behind privateness cash:

Stealth Addresses: Generate distinctive, one-time addresses for each transaction, making certain that no two transactions may be linked again to the identical consumer.Ring Signatures: Cover the sender’s id by mixing the transaction particulars with others, making it extraordinarily tough to hint.Confidential Transactions: Cover the transaction quantity, making certain delicate monetary particulars stay non-public.Zero-Information Proofs: Permit verification of transactions with out revealing any particulars concerning the sender, receiver, or quantity.

How Privateness Cash Guarantee Transaction Anonymity

Privateness-focused altcoins implement superior mechanisms to ensure that each transaction stays nameless and untraceable. In contrast to conventional cryptocurrencies, which brazenly show transaction particulars on a public ledger, privateness cash are constructed to protect delicate data such because the sender’s id, recipient particulars, and transaction quantities.

Stealth addresses are one of many core applied sciences used. These addresses create a singular, one-time code for each transaction. This ensures that even when somebody examines the blockchain, they can’t hyperlink a number of transactions to the identical consumer. This function is especially precious for people who prioritize confidentiality of their monetary dealings.

Ring Signatures are one other important instrument. They work by mixing the sender’s transaction with a number of others, creating a bunch of potential senders. This makes it almost inconceivable to pinpoint the precise origin of the transaction, providing an extra layer of anonymity.

Zero-Information Proofs additional improve privateness by permitting the verification of transactions with out exposing any particulars concerning the events concerned or the quantity being transferred. This ensures that customers can preserve full confidentiality whereas nonetheless adhering to the blockchain’s safety protocols. These applied sciences collectively empower privacy-focused altcoins to offer a safe and nameless setting for digital transactions, assembly the wants of customers who demand discretion and knowledge safety.

Fashionable Privateness Cash You Ought to Know

Privateness cash differ in how they method anonymity, auditability, and community design. Some implement privateness by default, whereas others permit customers to decide on when to protect transaction knowledge. Understanding these variations helps clarify why sure initiatives proceed to draw customers who wish to purchase privateness cash with out KYC and cut back long run publicity to monetary surveillance. Listed here are standard choices:

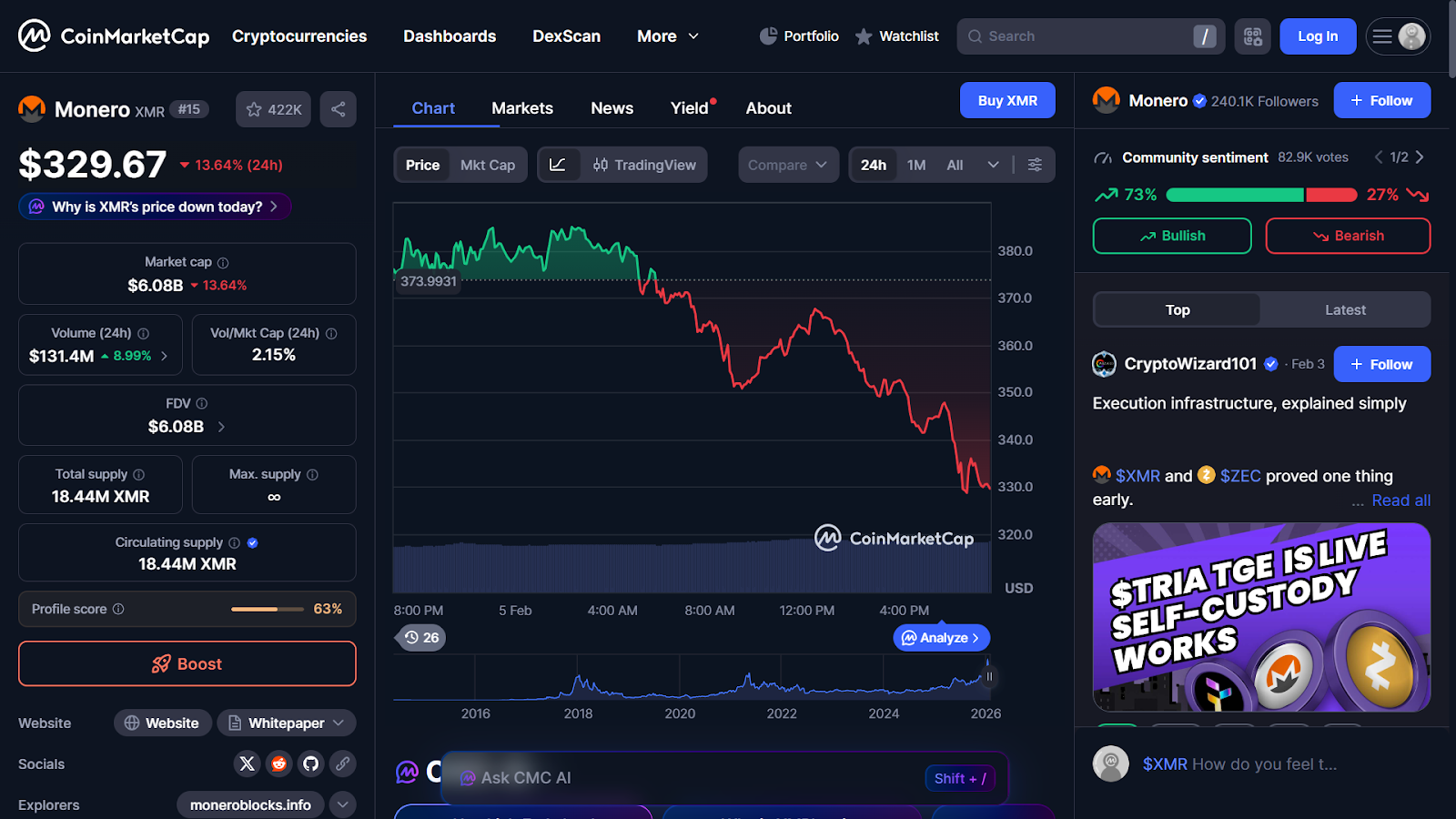

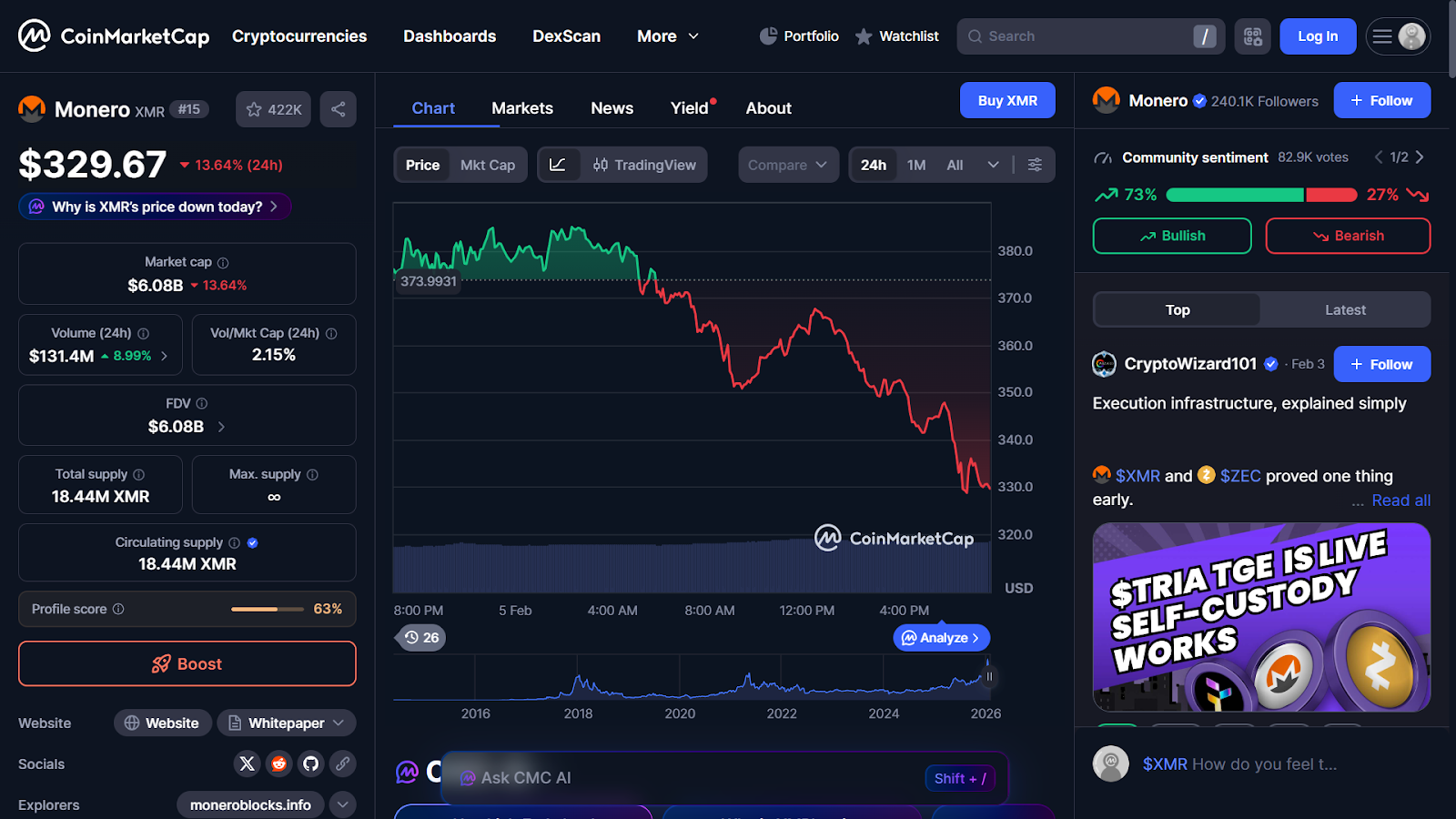

1. Monero (XMR)

Monero focuses on default privateness, that means each transaction is protected with out requiring consumer motion. It makes use of ring signatures, stealth addresses, and ring confidential transactions collectively, making sender, receiver, and quantity data indistinguishable on the blockchain. This design makes Monero immune to chain evaluation and tough to blacklist, which is why it’s usually used for peer to see funds the place privateness is non negotiable.Monero’s consistency is its power. As a result of all transactions comply with the identical privateness guidelines, there is no such thing as a transparency leakage brought on by non-obligatory settings or combined transaction varieties.

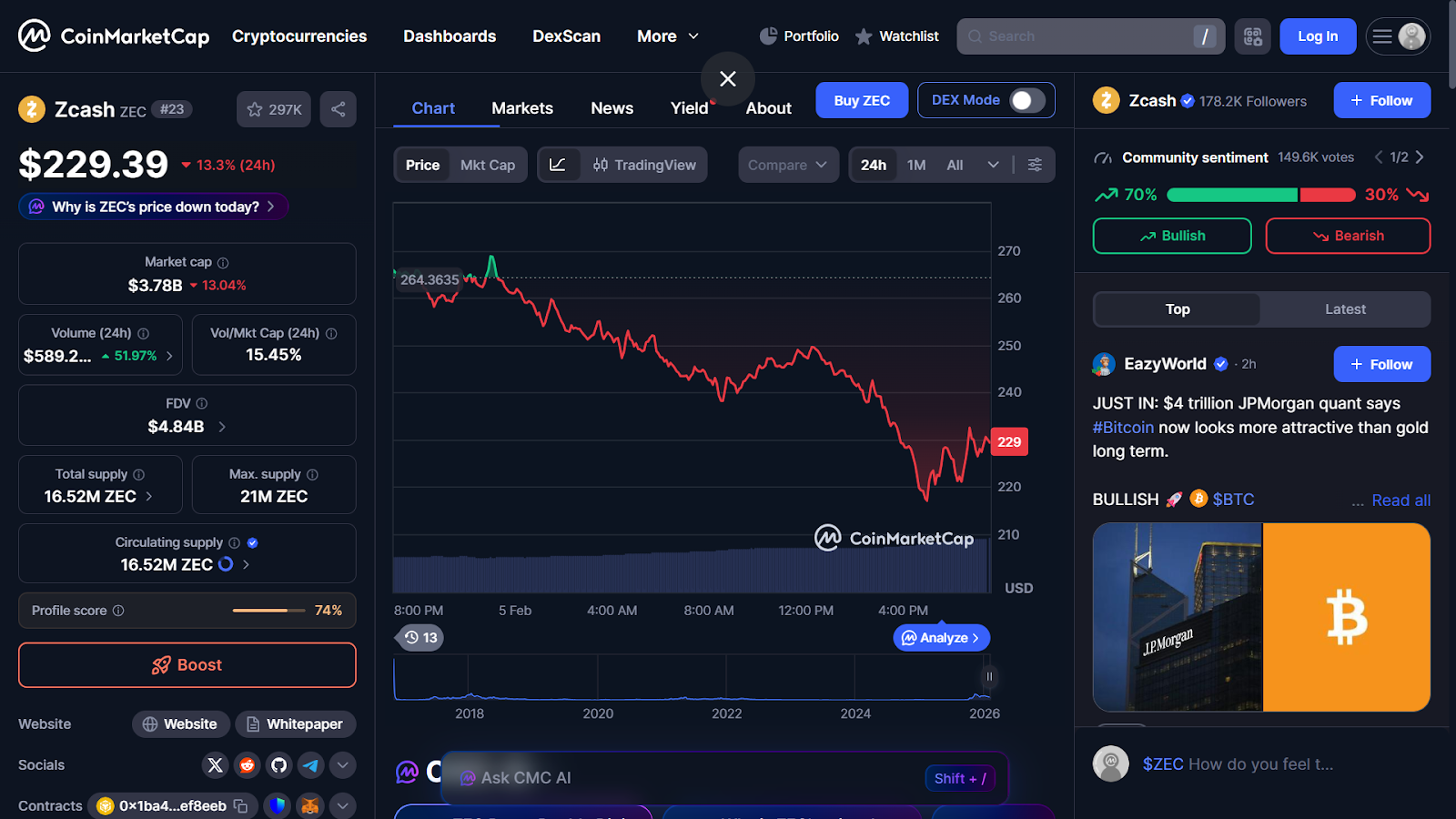

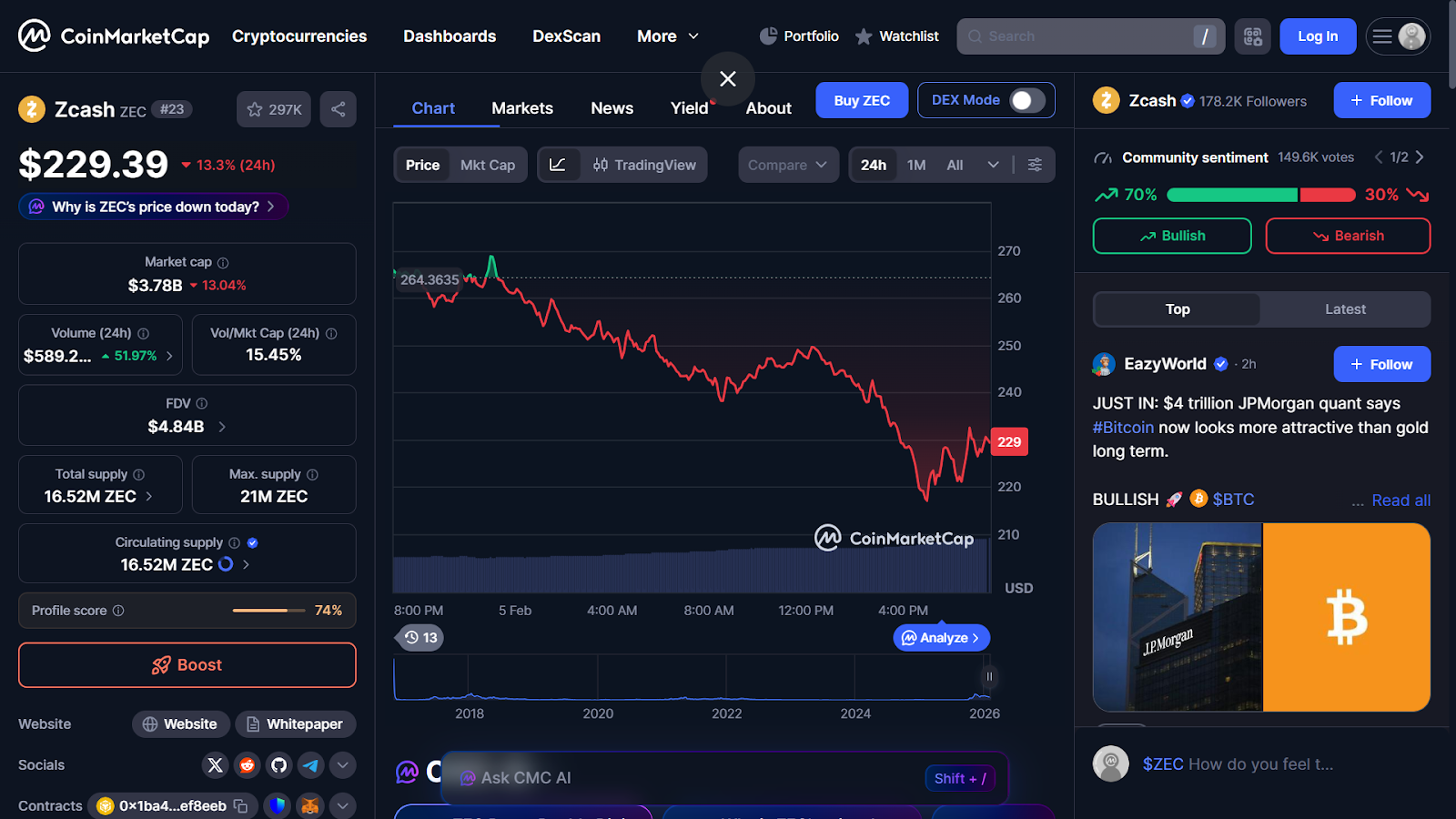

2. Zcash (ZEC)

Zcash presents a selective privateness mannequin that permits customers to decide on between clear and shielded transactions. Its core know-how depends on zero data proofs, enabling the community to substantiate transactions with out revealing delicate particulars. This flexibility appeals to customers who need privateness when wanted whereas nonetheless interacting with clear techniques. Nonetheless, non-obligatory privateness additionally creates utilization patterns that may be analyzed. When shielded transactions are underused, anonymity units shrink, which might weaken general privateness ensures in comparison with all the time non-public networks.

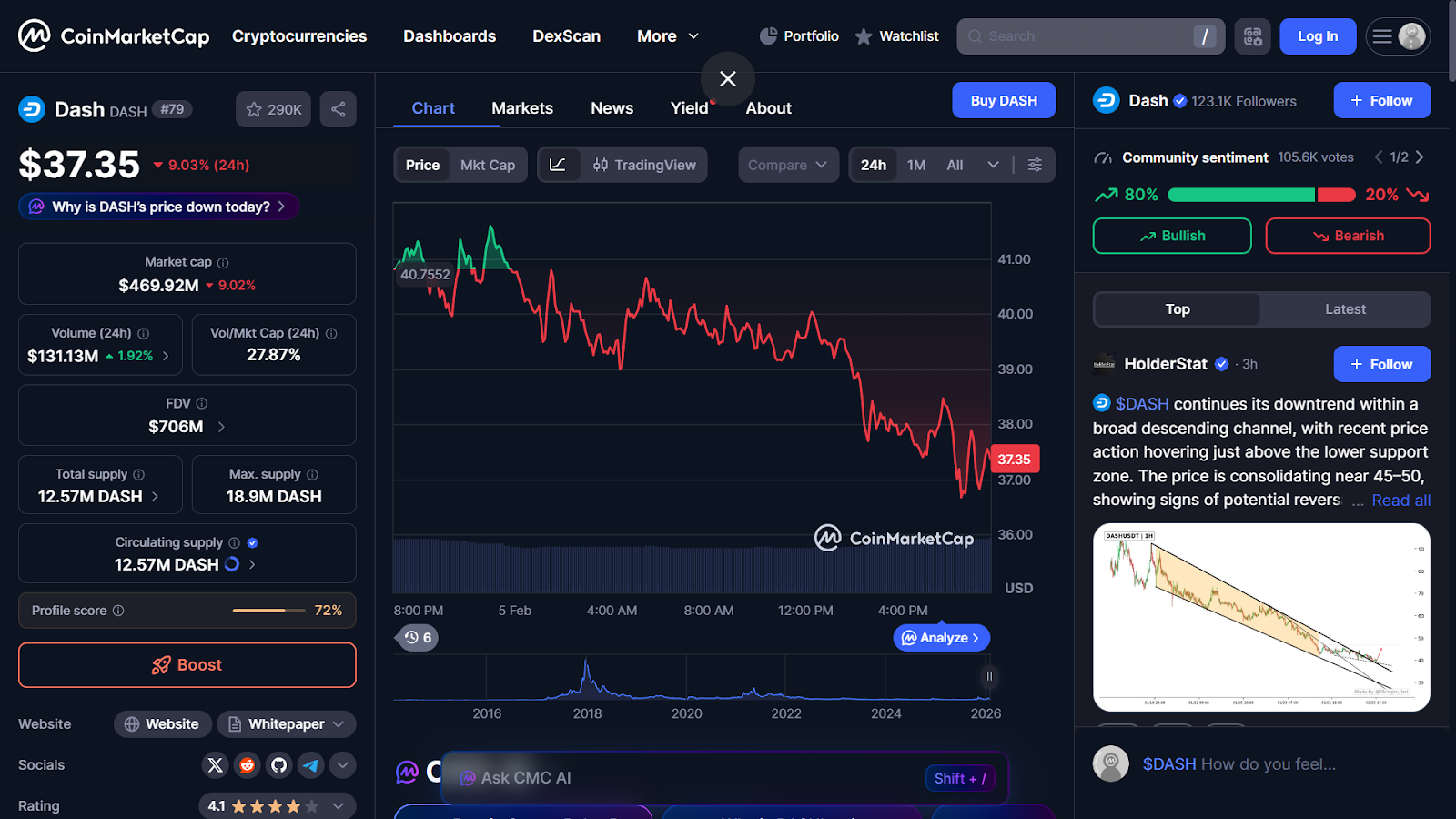

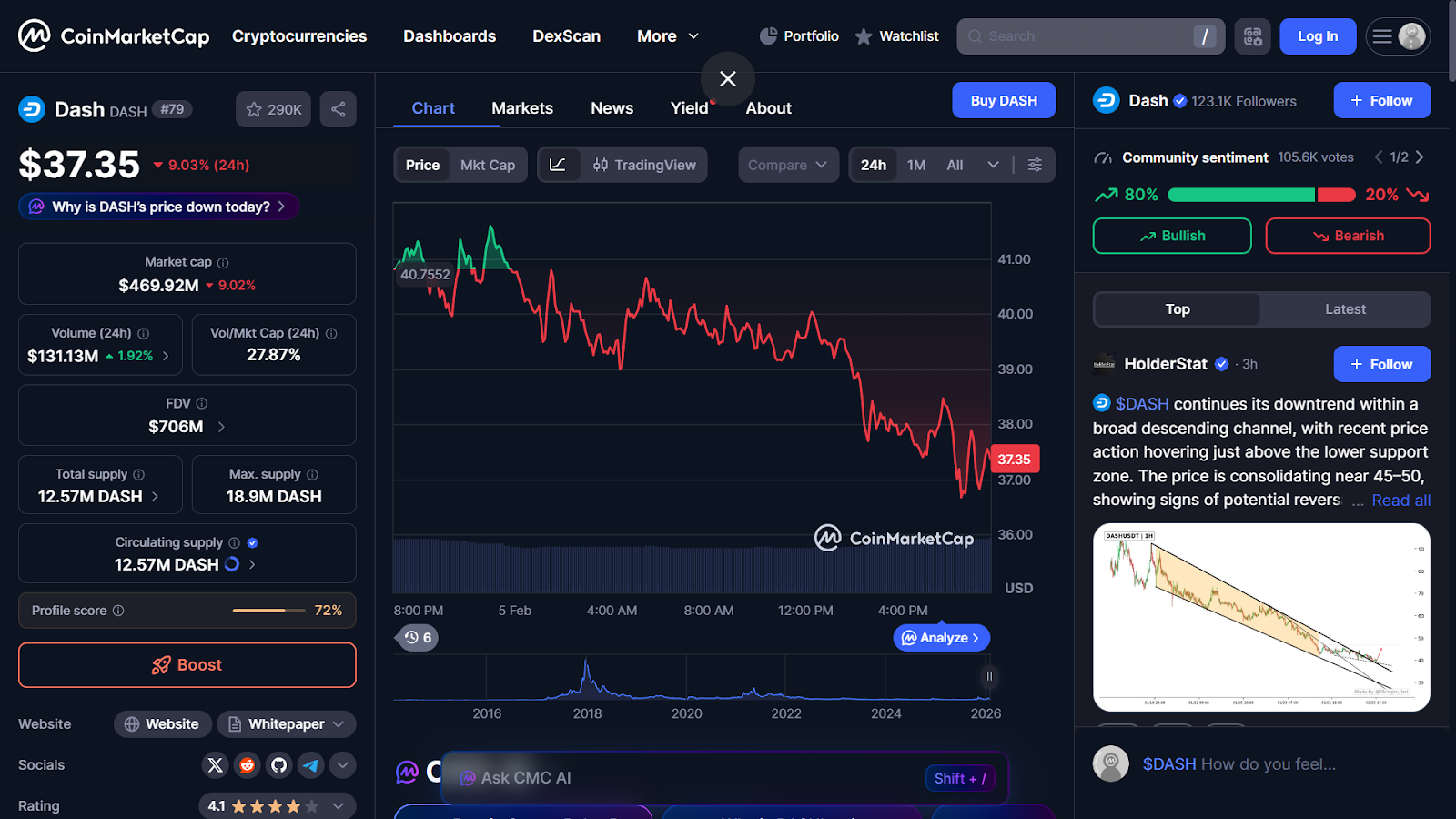

3. Sprint (DASH)

Sprint approaches privateness by an non-obligatory mixing function relatively than full protocol-level obfuscation. Its PrivateSend operate combines a number of transactions to make tracing tougher, whereas the blockchain itself stays largely clear. Because of this, Sprint presents higher accessibility however much less privateness than cryptocurrencies designed completely for anonymity.

Market individuals sometimes classify Sprint as a payment-focused cryptocurrency with added privateness instruments relatively than a real privacy-first asset, which influences how exchanges and regulators deal with it.

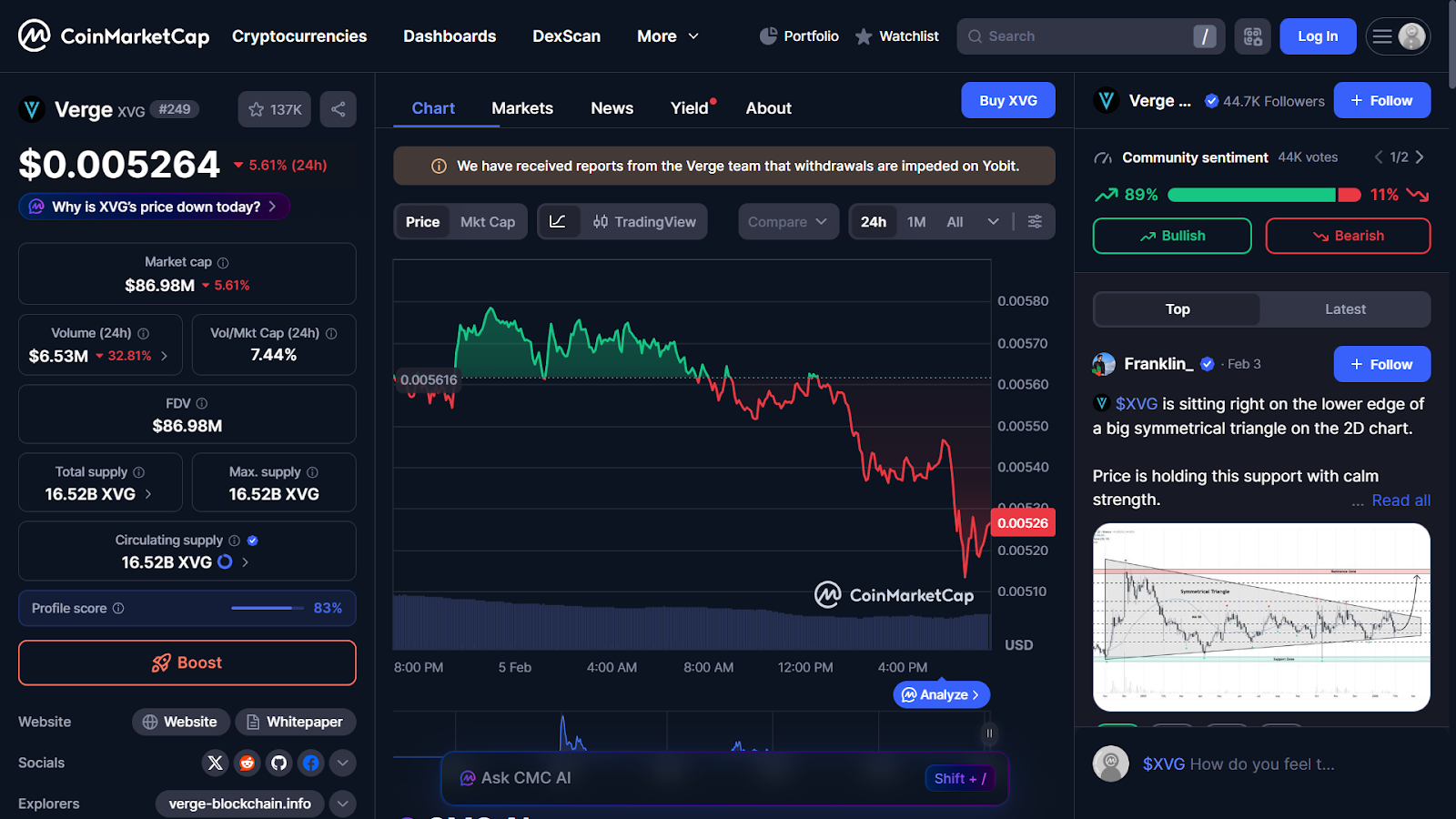

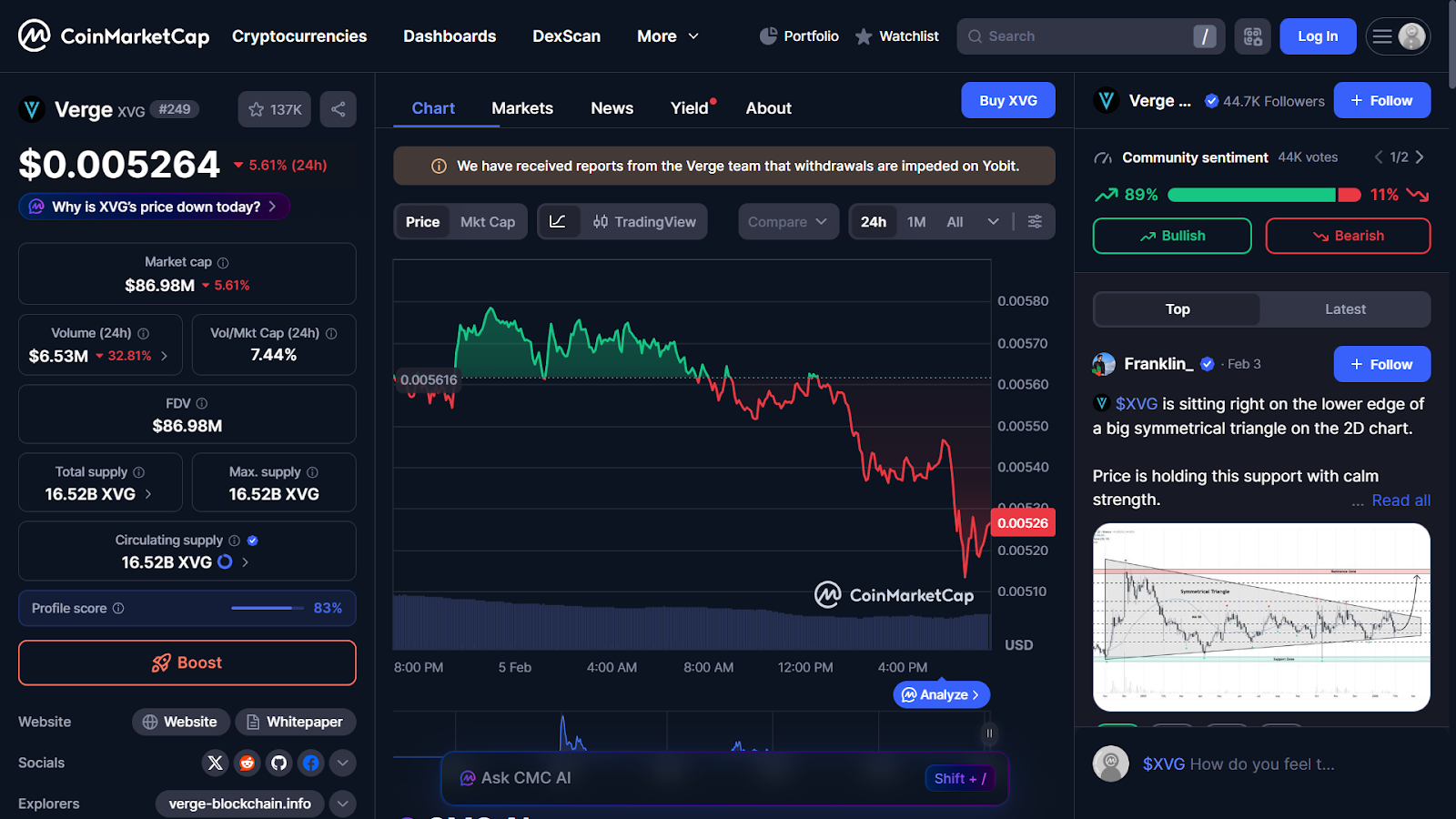

4. Verge (XVG)

Verge emphasizes community degree privateness by routing transactions by anonymity networks akin to Tor and I2P. This hides consumer IP addresses and site knowledge, decreasing the danger of community surveillance. The blockchain itself stays clear, however metadata publicity is considerably restricted. This method advantages customers involved about actual world id leaks relatively than on chain transaction tracing, making Verge a definite possibility amongst privateness centered cryptocurrencies.

5. Pirate Chain (ARRR)

Pirate Chain enforces privateness always by utilizing shielded transactions completely. Constructed on zero data proof know-how, it removes the choice for clear transfers fully. Each transaction is absolutely non-public by default, rising anonymity units and decreasing behavioral evaluation dangers. As a result of transparency is rarely allowed, Pirate Chain appeals to customers who need most privateness ensures and minimal compromise. This strict design selection locations it firmly on the privateness maximalist finish of the spectrum.

Advantages of Utilizing Privateness Cash

Enhanced Anonymity: Privateness cash be sure that your id and transaction particulars stay confidential, defending you from undesirable scrutiny.Safe Non-public Transactions: These cash use superior cryptographic methods to safeguard delicate monetary actions, making certain peace of thoughts.Freedom from Oversight: Privateness cash permit customers to conduct transactions with out interference from third events or regulatory our bodies.Monetary Independence: They empower customers to take care of management over their funds with out counting on centralized techniques.

Dangers and Challenges of Privateness Cash

Regulatory Scrutiny: Governments and monetary establishments usually view privateness cash with suspicion, resulting in potential restrictions or bans.Affiliation with Illicit Actions: The anonymity provided by privateness cash can appeal to misuse, tarnishing their repute.Restricted Adoption: Privateness cash will not be as broadly accepted as mainstream cryptocurrencies, which might restrict their usability.Volatility: Like different cryptocurrencies, privateness cash are topic to vital worth fluctuations, posing dangers for traders.

Regulatory and Authorized Concerns for Privateness Cash

Privateness cash have sparked vital debate amongst regulators and regulation enforcement businesses as a result of their capability to obscure transaction particulars. Whereas these cash present customers with enhanced anonymity, additionally they elevate issues about potential misuse for unlawful actions akin to cash laundering and tax evasion.

Regulation enforcement businesses usually battle to hint transactions involving privateness cash, which complicates efforts to fight monetary crimes. This has led to elevated scrutiny and, in some instances, outright bans or restrictions on using privacy-focused cryptocurrencies in sure jurisdictions. Then again, advocates argue that privateness cash are vital for safeguarding particular person freedoms and storing privateness cash in a crypto pockets.

How Do Privateness Cash Differ From Common Cryptocurrencies?

Privateness cash stand other than common cryptocurrencies by prioritizing anonymity and confidentiality in transactions. Whereas conventional cryptocurrencies like Bitcoin and stablecoins concentrate on transparency and stability, privateness cash are designed to protect consumer identities and transaction particulars. Let’s discover these variations intimately.

Privateness Cash vs Bitcoin

FeaturePrivacy CoinsBitcoinAnonymityTransactions are untraceable and personal.Transactions are publicly seen on the blockchain.Transaction ParticularsHidden from public view.Absolutely clear and accessible to anybody.Use CaseExcellent for personal transactions.Appropriate for general-purpose transactions.

Privateness Cash vs Stablecoins

Whereas privateness cash emphasize anonymity, stablecoins are designed to take care of a secure worth by being pegged to property akin to fiat currencies. In distinction, stablecoins are sometimes used to reduce volatility in on a regular basis monetary transactions, whereas privateness cash attraction to customers who prioritize confidentiality.

Privateness Cash vs Safety Tokens

Safety tokens signify possession in an asset or firm and are topic to strict laws. Privateness cash, then again, are decentralized and improve consumer anonymity. Safety tokens are sometimes used for funding functions, whereas privateness cash are tailor-made for safe, non-public transactions. These distinctions spotlight the distinctive position privateness cash play within the cryptocurrency ecosystem, providing options for customers who prioritize discretion and safety.

Easy methods to Purchase Privateness Cash Safely

Understanding how privateness cash match into cryptocurrency is crucial earlier than making a purchase order. These cash are designed to prioritize anonymity and safety, making them a singular phase of the digital foreign money market. To purchase privateness cash safely, comply with these steps:

Step 1: Select a Respected Trade

Choose a cryptocurrency trade that helps privateness cash and has a robust repute for safety. Search for platforms that provide strong encryption and two-factor authentication.

Step 2: Analysis KYC Necessities

Some exchanges require Know Your Buyer (KYC) verification, whereas others will let you purchase privateness cash with out KYC. If anonymity is a precedence, go for platforms that align together with your privateness preferences.

Step 3: Use a Safe Pockets

Retailer your privateness cash in a safe, non-custodial pockets. {Hardware} wallets are a superb selection for long-term storage, as they supply an added layer of safety in opposition to hacks.

Step 4: Confirm Transaction Particulars

Double-check all transaction particulars earlier than confirming a purchase order. Privateness cash usually use superior applied sciences like stealth addresses, so make sure you’re acquainted with the method.

Ought to You Spend money on Privateness Cash in 2026?

Because the demand for monetary privateness grows, privateness cash have gotten an more and more engaging funding possibility in 2026. These cryptocurrencies supply distinctive benefits, akin to enhanced anonymity and safe monetary transactions, making them a precious addition to a diversified portfolio. Nonetheless, earlier than investing, it’s important to think about elements like market volatility, regulatory scrutiny, and the long-term viability of those cash.

For these , utilizing the finest wallets for privacy-focused cryptocurrencies, akin to {hardware} wallets or privacy-centric software program wallets, ensures safe storage and safety of your property. Whereas privateness cash current vital alternatives, additionally they include dangers. Regulatory challenges and restricted adoption in mainstream markets can impression their development potential. Buyers ought to conduct thorough analysis, keep knowledgeable about authorized developments, and consider their danger tolerance.

Conclusion – Is a Privateness Coin Well worth the Funding?

Privateness cash generally is a precious funding for many who prioritize monetary anonymity and safety. Whereas they provide distinctive advantages, akin to untraceable transactions and enhanced privateness, potential traders should weigh the dangers, together with regulatory scrutiny and market volatility. With correct analysis, safe storage utilizing the perfect wallets for privacy-focused cryptocurrencies, and a transparent understanding of your monetary targets, privateness cash generally is a strategic addition to your portfolio.

FAQs

What are the perfect privateness cash to put money into 2026?

The most effective privateness cash to put money into 2026 embody Monero (XMR), Zcash (ZEC), Sprint (DASH), Verge (XVG), and Pirate Chain (ARRR), as they provide superior privateness options and robust neighborhood help.

Can privateness cash be traced?

Privateness cash intention to be untraceable by utilizing applied sciences like stealth addresses, Ring Signatures, and Zero-Information Proofs, making it extraordinarily tough to hint transaction historical past.

How do privateness cash work otherwise from Bitcoin?

Privateness cash work otherwise from Bitcoin by concealing transaction particulars akin to sender, recipient, and quantities, whereas Bitcoin transactions are absolutely clear and recorded on a public ledger.

Are privateness cash authorized?

Privateness cash are authorized in lots of international locations, however their use is topic to regulatory scrutiny and restrictions in some areas as a result of issues about anonymity and potential misuse.

Why are privateness cash necessary for monetary privateness?

Privateness cash are necessary for monetary privateness as a result of they defend consumer identities and transaction particulars.