FDV (Absolutely Diluted Valuation) is the full market worth of a crypto token if each coin from its most provide had been already in circulation. It issues as a result of it reveals the true potential dimension of a cryptocurrency undertaking, not simply what’s seen from at the moment’s small circulating provide. Additionally, it’s a key metric merchants use to evaluate how a lot future dilution may affect value, particularly when locked tokens begin unlocking later.

On this information, you’ll study precisely the best way to calculate FDV, the way it compares with market cap, and when a excessive FDV ought to make you cautious earlier than shopping for into a brand new altcoin.

What’s FDV (Absolutely Diluted Valuation) in Crypto?

FDV (Absolutely Diluted Valuation) is a projection of a crypto undertaking’s complete market worth, assuming that each single token the undertaking is ever going to create is already in circulation proper now. You possibly can consider it this fashion: it offers you the theoretical most worth of the complete undertaking. In crypto buying and selling, FDV performs a key function in understanding long-term value potential and dilution danger.

Fast Tip: In a crypto undertaking, the circulating provide is the variety of cash obtainable to the general public and actively buying and selling, whereas the utmost provide is definitely the hard-coded cap on the full variety of cash that can ever exist over the undertaking’s lifetime. FDV considers most provide, not present circulating provide.

You understand, while you see a cryptocurrency listed on an change, you principally see its present value, which is multiplied by the tokens which might be presently in circulation. Properly, that quantity is the present “Market Cap”, however we are going to speak extra about that later. FDV takes issues a bit additional.

FDV seems into the long run, because it considers each token that’s locked up. Right here, these locked tokens embrace those reserved for the founding workforce, the early buyers, the tokens stored for future growth funding, and even tokens that might be launched as rewards for staking or mining over the subsequent a number of years. So, you’ll be able to see that FDV is sort of a sneak peek into the undertaking’s full financial scale. Therefore, you might be primarily asking: “what is that this undertaking price if all of the tokens had been obtainable to be purchased or offered at the moment?”

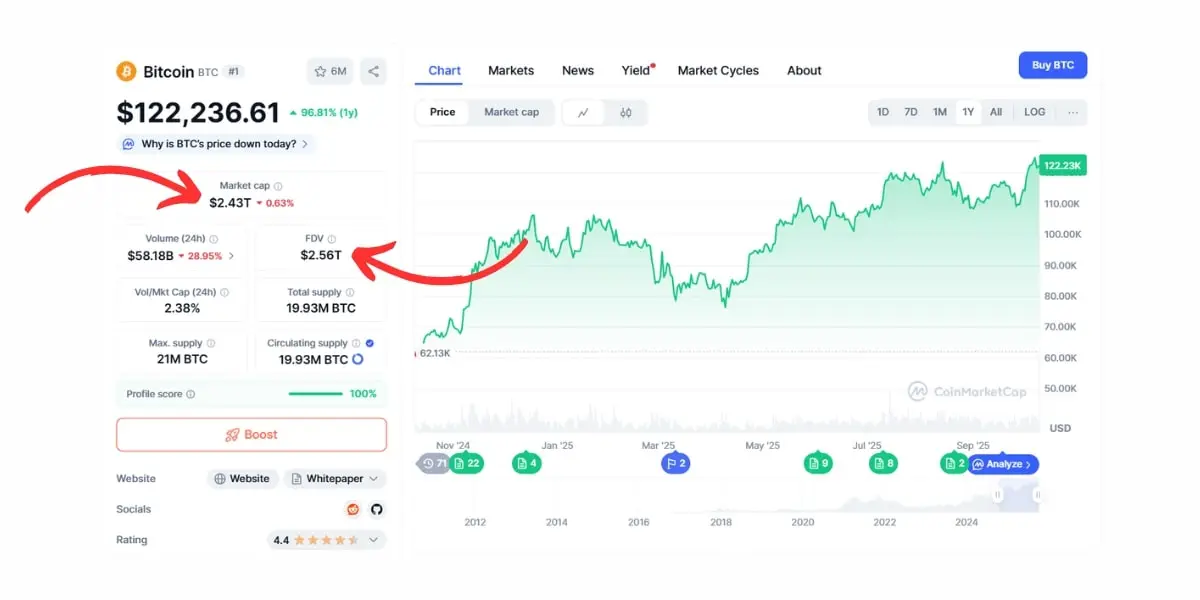

Now think about Bitcoin. You understand, it has a set most provide of 21 million cash, and about 19.93 million are already in circulation at the moment. At a value of $122,236 per BTC, the market cap is roughly $2.56 trillion (19.93 million × $122,236). However, right here, the FDV is $2.56 trillion (21 million × $122,236). Therefore, the small hole really exhibits that the majority bitcoins are already on the market, however not 100%.

Now, in case you are shopping for altcoins, understanding FDV is much more essential. As a result of a excessive FDV with a small present provide can finally restrict future upside as soon as new tokens unlock. You possibly can discover our listing of greatest altcoins to purchase right here.

Why FDV Issues in Crypto Investing?

FDV issues in crypto investing as a result of it ought to instantly trigger you concern when it’s considerably greater, generally 10, 50, and even 100 occasions greater than the present Market Cap. This sort of distinction is definitely the most important warning signal as a result of it strongly suggests excessive future dilution danger.

You see, the FDV metric is definitely a theoretical quantity as a result of it assumes the token value will keep the identical even when all these new tokens are launched. However in actuality, that just about by no means occurs. So, when enormous quantities of tokens unlock, they typically create intense promoting stress.

Now, let’s have a look at why this hole between the present worth (Market Cap) and the utmost theoretical worth (FDV) is so dangerous for you:

Large Token Unlocks: As we mentioned, a typical new undertaking would possibly launch with solely 10% or 15% of its complete provide unlocked. And, the remaining 85% to 90% is about to unlock over a number of years, often for the workforce, advisors, and a few large non-public sale buyers. In lots of initiatives, a good portion of those tokens goes to insiders who could promote as soon as unlocked. You understand, many initiatives at the moment comply with a vesting schedule the place tokens unlock linearly over 3-5 years. Now, think about a 3-year vesting schedule, the place each single day, new tokens are launched from the locked pool. Properly, this can add fixed promoting stress to the market, and if there isn’t sufficient new cash coming in to purchase these extra tokens, the worth simply drops over time.Sign of Overvaluation: An excellent excessive FDV typically indicators that the undertaking is overvalued, and its present value is principally pushed by hype, not by any actual utility or adoption. All the time verify whether or not the token utility genuinely helps long-term worth or if it’s simply speculative. Additionally, that is why many analysts at the moment typically speak concerning the “FDV/Market Cap ratio” being too excessive.Emission charges and rewards: Some crypto networks mint new tokens constantly as staking or liquidity rewards. Therefore, excessive emissions add a gradual provide and might weigh on costs if demand doesn’t sustain, particularly when general demand and provide circumstances out there flip weak.The Founder/Group Danger: While you see a undertaking with a low circulating token provide, it typically means the workforce and the earliest non-public buyers maintain a lot of the remaining locked tokens. Really, they’re holding all of the “paper wealth”. Now, when their tokens lastly unlock, they’re usually incentivized to promote, particularly if the undertaking hasn’t lived as much as its preliminary hype. So, this one additionally creates promoting stress.Low Liquidity Points: Generally, a low circulating provide and a excessive FDV end result within the token having poor liquidity. Since solely a small little bit of the full provide is definitely buying and selling, a big purchase or promote order can transfer the worth dramatically, and this results in excessive volatility, making the asset a lot riskier. Therefore, it means you won’t be capable to promote your tokens simply with out crashing the worth your self.

Additionally, TVL (Whole Worth Locked) is even one other essential metric to guage, particularly while you’re analyzing DeFi initiatives. You possibly can learn our full information on what TVL in crypto is.

Easy methods to Calculate FDV?

To calculate FDV, it is advisable to multiply the crypto undertaking’s present token value by the utmost complete provide. So, calculating the Absolutely Diluted Valuation is definitely fairly easy since you solely want two fundamental items of data. First, it’s essential to know the precise most provide of the token, after which the present market value of 1 token.

Right here is the system to calculate FDV –

FDV = Present Token Worth x Most Whole Provide

Right here, this most complete provide is the important thing time period, and it really refers back to the absolute most variety of tokens that can ever exist for that undertaking. You possibly can simply discover this quantity within the undertaking’s whitepaper, its official documentation, and even on some main crypto information web sites like CoinMarketCap or CoinGecko. And, the present value is simply the worth you see it buying and selling at proper now.

Now, let’s stroll by means of a simple instance, simply to be sure you get it completely.

Step 1: Discover the Present Worth: You verify the change and see that the worth of 1 $GAME token is round $2.50.Step 2: Discover the Most Whole Provide: You lookup the tokenomics and discover that the utmost provide is fastened at 500,000,000 $GAME tokens. Additionally, this quantity won’t ever change, usually talking, which is essential for the calculation.Step 3: Calculate the FDV: You merely have to multiply these two numbers collectively.

FDV = $2.50 x 500,000,000 = $1,250,000,000

So, the Absolutely Diluted Valuation for Challenge $GAME is $1.25 billion.

Now, let’s say $GAME presently solely has 50 million tokens really circulating out there. Therefore, its present Market Cap could be $2.50 x 50,000,000, which is simply $125 million. Now once more, have a look at that distinction. The $1.25 billion FDV tells you that this coin is actually priced as a $1.25 billion undertaking at the moment, despite the fact that its present market capitalization is just $125 million.

Fast Tip: By no means combine circulating provide with the utmost provide, or else you’ll find yourself calculating the present market cap as an alternative of FDV.

Additionally, the FDV calculation is completely completely different for cryptocurrencies that don’t have a tough cap on their provide, like within the case of Ethereum, for instance. Ethereum’s provide is technically uncapped, that means new ETH will be created over time, though its tokenomics are complicated and alter primarily based on community exercise like burning.

So, for cash with no most provide, calculating a really significant FDV turns into actually troublesome, perhaps even inconceivable in the best way we simply described, as a result of that essential “Most Whole Provide” quantity is all the time transferring or just doesn’t exist as a set quantity. So, usually, FDV is most helpful for cash which have a set, onerous restrict on what number of tokens can ever be created.

What’s a Good FDV Ratio in Crypto?

There isn’t any single “good” FDV ratio, as it’s a subjective metric that truly relies upon closely on the particular undertaking, its stage, tokenomics, and an investor’s danger tolerance.

You possibly can calculate the FDV ratio (Market Cap / FDV) and visualize it on this means:

Greater Ratio (nearer to 1, or 100%): Properly, that is usually seen as a safer and extra steady signal as a result of most tokens are already in circulation.Decrease Ratio (e.g., beneath 0.5): This means that truly a big portion of the token provide remains to be locked and might be launched sooner or later. So, there’s a future dilution danger.

You understand, the chance is excessive dilution right here. So, if the FDV is, say, 15x the circulating market cap, you’ll face large potential provide inflation that would crush the token value as vesting schedules unlock. Typically, a wholesome FDV-to-Market Cap ratio is often thought of to be within the 2x to 5x vary.

FDV vs. Market Cap: What’s the Distinction?

Market cap and FDV each multiply a value by a provide quantity, however they really inform completely different tales. Market cap makes use of the circulating provide, which counts solely the tokens which might be obtainable for buying and selling proper now. Mainly, it solutions the query, “How a lot is the undertaking price at the moment primarily based on the cash individuals can really purchase or promote?”

However, FDV makes use of the utmost complete provide, which incorporates all cash that would ever be created. It usually solutions, “What would the undertaking be price if each doable token already existed and traded at at the moment’s value?”

What it measuresMarket capFully Diluted Valuation (FDV)Provide quantityMakes use of the present circulating provide solelyMakes use of the utmost complete provide (together with future unlocks)FormulationWorth × circulating provideWorth × most complete provideFuture provide included?NoSureWhat it tells youPresent dimension and liquidityPotential dimension if all tokens are outBlind spotIgnores locked and vesting tokensAssumes value stays the identical as provide growsGreatest useEvaluating initiatives at the moment, gauging buying and selling depthAssessing lengthy‑time period dilution and provide danger

Market cap is sweet for sorting initiatives by liquidity and dimension at the moment. If a coin has $500 million in market cap and one other has $5 billion, you realize the latter is way larger and doubtless has deeper markets. So, Market cap is mainly good for serving to merchants decide if a coin is giant sufficient to soak up large orders with out super value slippage. It’s additionally good for evaluating how a lot cash is invested in varied ecosystems at the moment.

FDV, then again, tries to take a look at the long run. It multiplies at the moment’s value by the utmost complete provide to estimate how large the undertaking may get if each token had been already circulating. This additionally makes it a great tool for detecting hidden dilution.

Take, for example, a token with a low market cap of $20 million however an FDV of $400 million. That twenty-to-one disparity signifies loads of locked tokens are on the best way. So, if you are going to buy the token at the moment, your stake could get diluted by a big margin as new cash get launched. Now, examine that to a token whose FDV and market cap are just about the identical, say Bitcoin (not a lot distinction). In that case, there isn’t a lot hidden or locked provide, so dilution danger is decrease.

What Are the Limitations of FDV in Crypto?

The primary limitations of FDV are that it’s a theoretical most worth, which ignores actual market demand and liquidity points, fails to account for the essential timing of future token unlocks, and turns into unreliable for tokens and not using a fastened provide cap.

Ignores liquidity and demand: FDV assumes all tokens will finally maintain the identical worth, nevertheless it actually doesn’t account for market demand or how simply these tokens will be traded.Hides Liquidity Issues: Mainly, it assumes which you can simply promote the complete provide on the present value. But when the circulating provide is tiny (low float), a excessive FDV means poor liquidity and makes the token extremely weak to a crash from a single giant vendor.Fails to Monitor Unlock Timing: It treats all locked tokens equally and ignores the essential vesting schedule. A 10x FDV is way riskier if the majority of that offer unlocks unexpectedly in a large cliff occasion versus a gradual launch.Meaningless for Dynamic Provide: You understand, if a token doesn’t have a set, onerous cap (like Ethereum), the “Most Whole Provide” is finally speculative solely or all the time altering. So, for these initiatives, calculating a dependable FDV is nearly inconceivable.

Therefore, it’s best to all the time use FDV as your dilution danger radar, however pair it with the present market cap and real adoption metrics like TVL to get an sincere valuation.