Tokenomics defines how a token is created, distributed, used, and sustained over time, and sometimes determines whether or not a mission will thrive or fail. As crypto advances, tokenomics has change into a vital framework for traders to guage long-term worth, incentives, and real-world impression. On this information, you’ll be taught what tokenomics actually means, how its core elements work collectively, and why it issues for traders, builders, and retail customers. Let’s dive in!

What’s Tokenomics?

Tokenomics is the financial framework that defines how a crypto token works inside a blockchain ecosystem. The idea combines token and economics to explain the principles governing a token’s creation, distribution, utility, incentives, long-term sustainability, and even removing from a community.

Tokenomics solutions the query of why a token exists, the function it performs within the ecosystem, how worth is created, who will get what proportion of the token equipped, and what’s preserved or burnt over time. Not like conventional monetary programs, the place central authorities management cash provide and coverage, crypto tokenomics is embedded instantly into sensible contracts.

A number of cryptocurrency initiatives have collapsed, wiping out billions in digital property, primarily as a result of flawed tokenomics. Some distinguished examples embrace:

Terra (LUNA/UST): The algorithmic stablecoin UST relied on a mint/burn mechanism with LUNA however lacked enough collateral, resulting in a loss of life spiral in 2022 during which UST misplaced its 1:1 peg to the US greenback and LUNA hyperinflated amid mass redemptions. This erased over $40 billion in market capitalization.OneCoin: Raised $4 billion by means of MLM and not using a practical blockchain, failing as a result of fraudulent tokenomics targeted on hypothesis fairly than verifiable tech.Axie Infinity (SLP): Play-to-earn token SLP flooded the market by way of extreme gameplay rewards outpacing sinks like breeding, inflicting persistent inflation and worth crashes as new participant inflow slowed.

These examples, together with others, present {that a} well-designed tokenomics mannequin ought to align incentives throughout all members within the community, together with customers, builders, and long-term holders.

Key Parts of Tokenomics

1. Token Provide

Token provide defines the whole tokens in existence, what number of will ever exist, and what number of are presently obtainable to the market. It covers three key elements: most provide, complete provide, and circulating provide, and so they form shortage, inflation, and long-term worth.

Tasks usually start by defining a most provide for his or her token, setting a transparent higher restrict on the variety of tokens that may ever be created. When a max provide exists, it introduces shortage by design, signalling that new tokens will ultimately cease being issued.

From there, complete provide represents the variety of tokens which have already been minted. This contains allotted tokens for the crew, traders, ecosystem funds, and future rewards, even when these tokens are locked or not but accessible. Whole provide helps traders perceive the mission’s full financial footprint, not simply what’s presently tradable.

Whereas max and complete provide matter in the long run, circulating provide issues most within the brief time period. Circulating provide focuses on the tokens actively obtainable available on the market and subsequently has probably the most rapid impression on the present market worth and liquidity. Nevertheless, a low circulating provide relative to complete or most provide can initially create upward worth strain, but it surely additionally raises questions on future dilution as locked tokens are step by step launched.

2. Token Distribution

Token distribution explains who receives tokens, once they obtain them, and below what situations. This instantly impacts decentralization, equity, and market stability. Distribution covers allocations to founders, early traders, the group, ecosystem funds, and community members corresponding to validators or liquidity suppliers.

In relation to token distribution, vesting schedules and lock-up durations are vital. They stop early stakeholders from dumping massive quantities of tokens instantly after launch. A well-balanced distribution reduces centralization threat and aligns long-term incentives, whereas poor distribution can focus energy, possibly among the many crew and early traders, and destabilize worth motion.

3. Token Utility

Token utility defines how the token is used throughout the ecosystem. With out clear utility, a token dangers changing into purely speculative, like many crypto initiatives and meme cash available in the market. Utility can embrace paying transaction charges, accessing platform options, staking to safe the community, offering collateral in DeFi protocols, unlocking premium providers, and even improvements.

Some tokens serve a number of features, whereas others are deliberately targeted on a single core use case. Whichever one a specific mission focuses on, the concept is to make sure the token has real-world use circumstances fairly than hype alone.

4. Demand and Incentives

Demand and incentives describe why customers would need to purchase and maintain the token, and what motivates them to take part within the community. Incentives could come within the type of staking rewards, yield farming, governance rights, airdrops, charge reductions, or entry to unique options.

On the token demand facet, usage-driven demand is extra sustainable than incentives that rely solely on excessive emissions. Certainly, the best token fashions steadiness rewards with utility. This steadiness ensures incentives encourage long-term participation fairly than short-term extraction, the place early traders dump their holdings after launch, leaving unsuspecting traders with nugatory tokens.

5. Burn Mechanisms

Burn mechanisms completely take away digital property from circulation, lowering provide over time. That is typically used as a counterbalance to inflation or ongoing token issuance. Burns could be triggered by transaction charges, protocol income, buyback packages, or particular consumer actions. When designed correctly, burn mechanisms can create deflationary strain and align token worth with ecosystem development.

6. Governance

Governance determines how selections are made inside a protocol and the way a lot affect token holders have over its future. In governance tokens/programs, holders can vote on proposals corresponding to protocol upgrades, parameter modifications, treasury utilization, or ecosystem funding. This shifts management away from centralized groups and towards the group.

Examples of Tokenomics: Actual-World Crypto Tasks

Let’s discover some real-world examples of token economics.

1. Bitcoin (BTC)

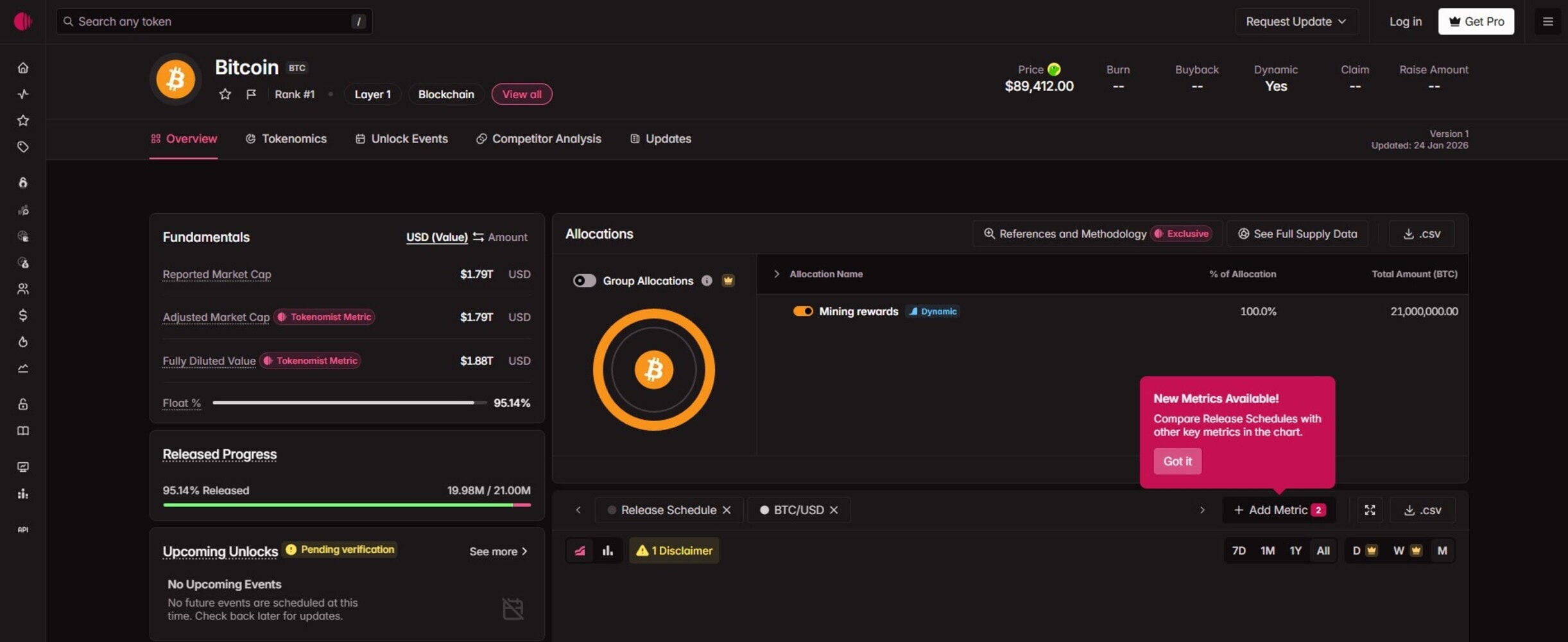

Bitcoin options one of many easiest and most sturdy tokenomics fashions in crypto, centered on absolute shortage and decentralized issuance. Its design prioritizes long-term worth storage over complicated utilities, distinguishing it from multi-function digital property.

Key options of Bitcoin’s Tokenomics

Fastened Provide Cap: Whole provide is hard-capped at 21 million BTC, with roughly 19.8 million in circulation as of early 2026. No extra cash can ever be created past this, implementing deflationary economics as cash are misplaced over time.Halving Mechanism: Mining rewards halve roughly each 4 years (final in 2024 at 3.125 BTC per block; subsequent in 2028), slowing new provide issuance till the ultimate block round 2140.Decentralized Distribution: BTC had a good launch with no pre-mine or crew allocation; early miners earned rewards organically. Transaction charges complement block rewards post-halvings, incentivizing community safety by way of Proof-of-Work with out centralized management.Core Utility Focus: BTC serves primarily as a retailer of worth and peer-to-peer medium of trade, with no governance, staking, or secondary features diluting its mannequin.

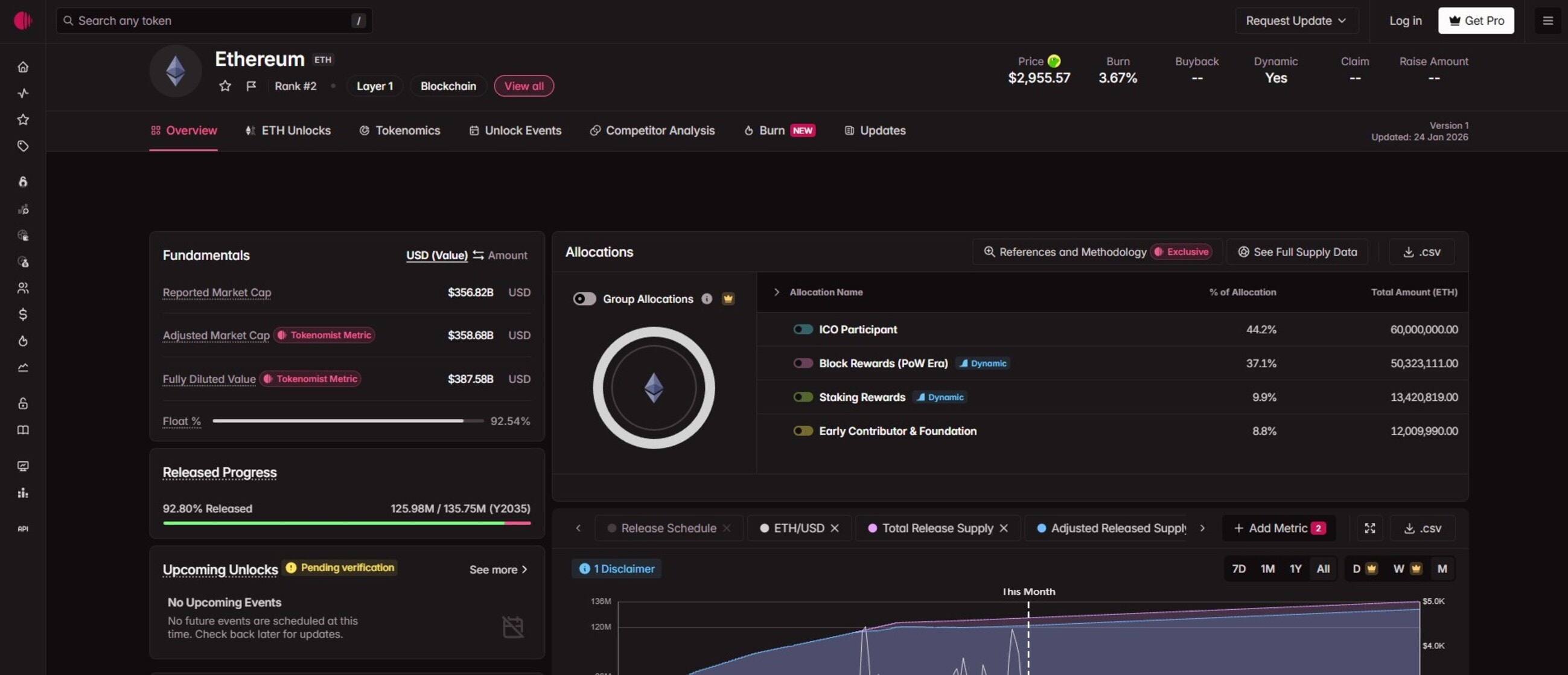

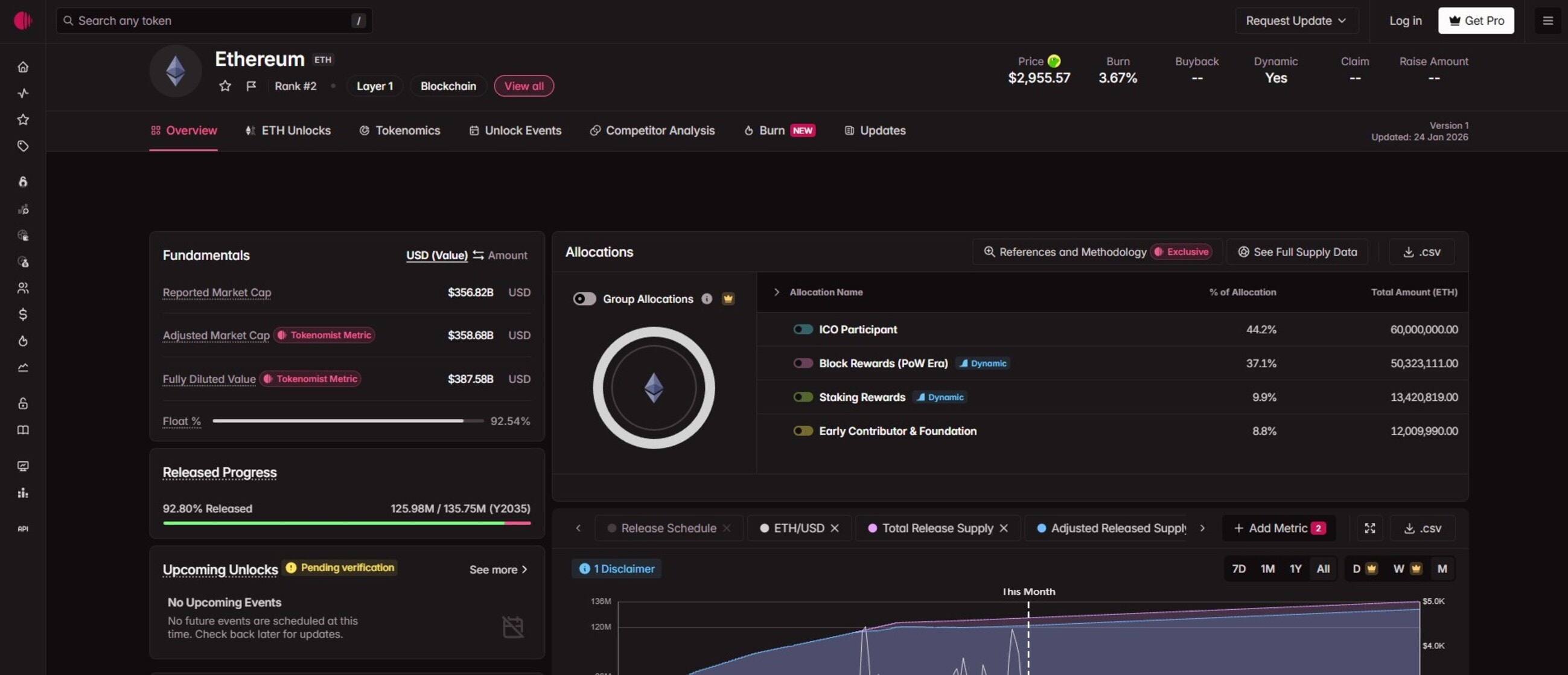

2. Ethereum (ETH)

Ethereum’s tokenomics has a dynamic provide mannequin formed by Proof-of-Stake issuance and EIP-1559 burns. Not like Bitcoin’s mounted cap, ETH’s worth is tied to community exercise throughout DeFi, NFTs, and Layer 2s. This dynamic strategy helps scalability upgrades, corresponding to these eyed for 2026.

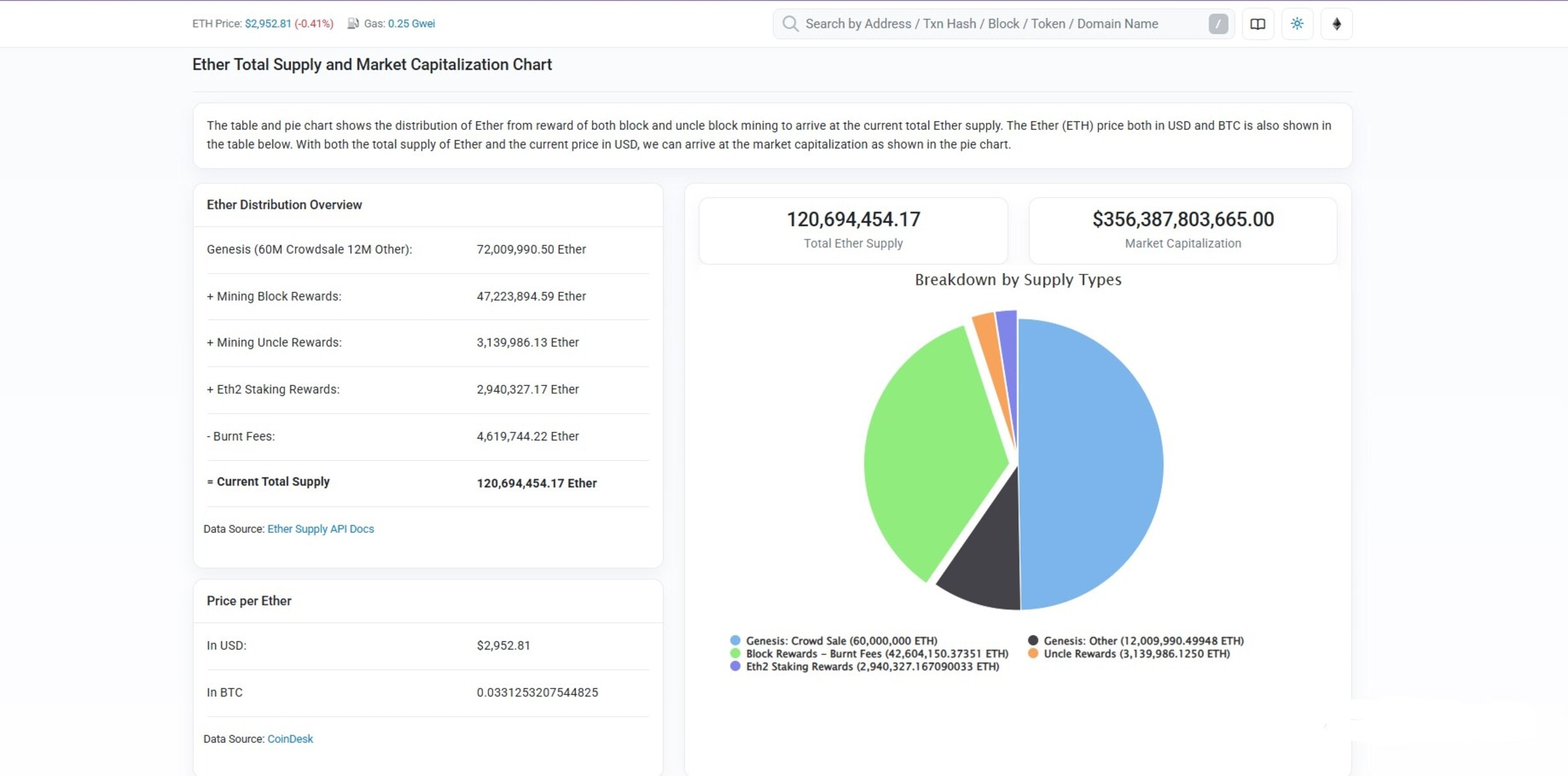

Key options of Ethereum’s Tokenomics

No Provide Cap: Whole token provide exceeds 120 million ETH in early 2026, with no higher restrict. New Ether (ETH) tokens are issued by way of staking rewards to validators securing the Proof-of-Stake consensus.Burn Mechanism: EIP-1559 (2021) auto-burns a portion of transaction charges, eradicating over 12.5 million ETH since launch and countering issuance. Surge in actions like NFT mints or DeFi booms speed up deflation, making it totally different from Bitcoin’s predictable halving occasions.Staking Incentives: 30% of ETH is staked for 3-5% APY, locking provide and enhancing safety with out crew allocations. Liquid staking (e.g., stETH) boosts liquidity for buying and selling on main exchanges.Multi-Utility Focus: ETH pays fuel for sensible contracts, governs by way of proposals, and serves as collateral in dApps, driving token demand past store-of-value. 2026 upgrades like Glamsterdam promise 10k TPS by way of ZK proofs, amplifying utility with out diluting core economics.

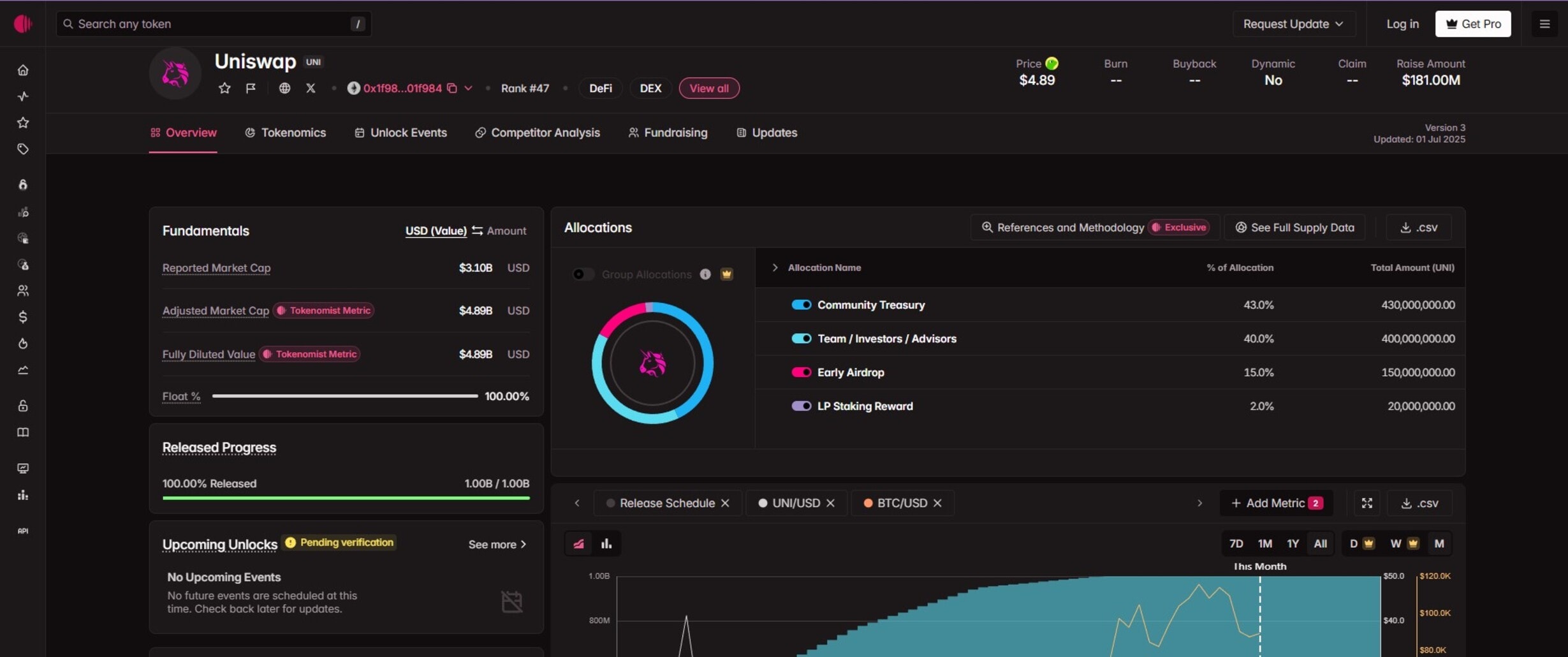

3. Uniswap (UNI)

Uniswap’s tokenomics emphasizes governance with current deflationary upgrades by way of the 2025 UNIfication proposal. This proposal will rework it from a pure governance token right into a value-accruing asset.

Key options of Uniswap’s Tokenomics

Fastened Provide with Burns: Whole provide is at 1 billion UNI, absolutely circulating since launch, however 100 million tokens ($596M worth) have been burned in late 2025 from treasury reserves as retroactive compensation for previous charges. Protocol charges from now circulate to TokenJar for automated UNI buybacks and burns by way of Firepit.Governance Incentives: UNI holders vote on upgrades, charge switches, and treasury (20M UNI/yr for grants beginning 2026), with no staking rewards or halvings like Bitcoin/Ethereum.UNI’s worth is tied to affect and long-term ecosystem alignment fairly than rapid money circulate.

4. Binance Coin (BNB)

Binance Coin (BNB) tokenomics centres on utility throughout the Binance ecosystem and BNB Chain. This mannequin helps its function as a centralized trade token powering low-fee buying and selling and blockchain operations.

Key options of Binance Coin’s Tokenomics

Quarterly Burns: Binance conducts automated burns each quarter utilizing 20% of BNB Chain’s fuel charges. This burn mechanism destroys tokens to focus on a max provide of 100 million from an preliminary 200 million. The present circulating provide of BNB is about 136 million after a number of burns, creating deflationary strain tied to community utilization, in contrast to the Ethereum community’s dynamic burns.Multi-Utility Design: BNB reductions buying and selling charges (as much as 25% on Binance), pays fuel on BNB Good Chain for DeFi/NFTs, permits staking yields, and grants governance/launchpad entry.Market demand scales with platform utilization, making BNB’s worth intently tied to ecosystem development.

Why Tokenomics Issues in Cryptocurrencies?

Tokenomics issues as a result of it determines whether or not a crypto mission can survive past hype. Whereas know-how defines what a blockchain can do, token economics units the principles for the way worth flows by means of a community, who earns rewards, who pays prices, and who holds decision-making energy.

Nicely-designed tokenomics, like Bitcoin’s 21 million cap or Ethereum’s burns, create shortage and counter inflation, stopping crashes seen in failures corresponding to Terra’s loss of life spiral. In the meantime, poor provide controls result in hyperinflation or dumps, eroding investor belief.

For builders, tokenomics acts as an incentive layer. It dictates how contributors are rewarded, how networks stay safe, and the way capital is allotted for future improvement. A powerful token mannequin can appeal to builders, bootstrap liquidity, and fund innovation with out counting on centralized management.

Superior Tokenomics Ideas

1. Sport Idea in Crypto Economics

Sport principle in crypto is the strategic decision-making framework used to design blockchain programs and incentives, guaranteeing all members act actually for mutual profit. It performs a foundational function in how blockchain networks perform and the way rational gamers like miners, validators, or merchants work together in aggressive environments to attain outcomes that profit all the community.

Crypto-economics blends sport principle with incentives to align self-interest with community well being. As an illustration, Proof-of-Stake slashes stakes for unhealthy actors, making dishonest too costly, whereas miners cooperate on consensus to maximise positive aspects.

One other instance of how that is applied is in Bitcoin mining. Right here, egocentric mining fails in the long run as sincere chains develop quicker, devaluing rewards. In the meantime, in DeFi protocols, liquidity suppliers earn charges however face dangers corresponding to impermanent loss, that are balanced by yields.

2. GameFi and Twin-Token Economies

GameFi introduces complicated financial programs the place tokens govern each participant incentives and long-term worth creation. Not like conventional gaming economies, that are centrally managed, GameFi depends on tokenomics to steadiness reward distribution, asset possession, and participant development in open markets.

Many GameFi initiatives undertake dual-token fashions to separate short-term utility from long-term governance or worth seize. One token is often earned by means of gameplay and used for in-game actions corresponding to upgrades or crafting, whereas the second token is scarce and used for governance, staking, or ecosystem selections.

3. Decentralized Bodily Infrastructure Networks (DePIN)

Decentralized Bodily Infrastructure Networks lengthen tokenomics past purely digital ecosystems into real-world coordination. In DePIN fashions, tokens are used to incentivize people and companies to deploy, keep, and function bodily infrastructure corresponding to wi-fi networks, vitality programs, sensors, or information storage {hardware}.

Tokenomics in DePIN should account for real-world prices, geographic constraints, and long-term upkeep, making incentive design considerably extra complicated. Rewards have to replicate precise utility supplied, corresponding to uptime, protection, or information high quality, fairly than easy participation.

Efficient DePIN tokenomics aligns financial incentives with measurable bodily output, enabling decentralized networks to scale with out centralized possession. Poorly designed fashions, nevertheless, threat overpaying for low-quality contributions or failing to maintain infrastructure as soon as early incentives decline.

Limitations and Challenges of Tokenomics

Tokenomics faces vital limitations that may undermine the mission’s token sustainability. These challenges typically stem from unpredictable markets, technical constraints, and exterior pressures, making flawless fashions uncommon.

Regulatory Uncertainty: Various international laws create compliance hurdles, elevating prices and limiting market entry for token initiatives. For that reason, smaller groups typically wrestle with authorized experience and ongoing monitoring, which may deter traders.Safety Dangers: Good contract vulnerabilities invite hacks and exploits, eroding belief regardless of audits.Market Manipulation and Volatility: Whales and pump-and-dump schemes distort costs in nascent markets, whereas excessive volatility disrupts long-term planning. Balancing incentives with out enabling centralization proves tough.Scalability and Interoperability: Rising consumer bases pressure blockchain infrastructure, slowing transactions and elevating charges. Cross-chain compatibility points additional restrict token utility throughout networks.

Consider a Undertaking’s Tokenomics Earlier than Investing

Listed below are some elements to think about earlier than investing in any crypto mission:

Token Provide Construction: Look past the utmost token provide and deal with how tokens enter circulation. A low circulating provide paired with massive future unlocks can create hidden dilution threat, particularly if early customers/traders or groups maintain vital allocations. Additionally, understanding vesting schedules and emission charges helps you anticipate when promoting strain could enhance.Token Distribution and Possession Focus: Tokens closely managed by insiders or a small variety of wallets typically sign governance threat and worth manipulation potential. A more healthy mannequin distributes tokens throughout customers, contributors, and ecosystem members in a manner that encourages decentralization and long-term dedication fairly than short-term exits.Verify Utility: Tokens with obligatory use circumstances, corresponding to paying charges, staking for safety, or accessing core options, are inclined to have extra resilient demand than these added purely for governance or incentives.Incentive and Rewards: Excessive rewards could look good, however unsustainable emissions typically result in inflation and declining costs as soon as development slows. Robust tokenomics balances incentives with actual financial exercise, guaranteeing rewards are funded by utilization or worth creation fairly than fixed token issuance.Governance: Governance mechanics present perception into who controls the protocol’s future. Clear voting programs, cheap quorum necessities, and safeguards in opposition to whale dominance recommend a extra resilient governance construction.

Rising Pattern in Tokenomics

1. Integration of Actual-World Property (RWAs)

The mixing of real-world property into tokenized programs is altering how worth is represented on-chain. RWAs carry historically illiquid property, corresponding to actual property, commodities, bonds, and personal credit score, into blockchain ecosystems. This enables them to be fractionalized, traded, and used as collateral.

RWAs introduce cash-flow-based demand and extra predictable financial conduct. Tokens backed by or linked to real-world property typically derive worth from yield era, income sharing, or rights to underlying digital tokens fairly than pure hypothesis.

2. GameFi and Twin-Token Economies

Early GameFi initiatives typically collapsed as a result of extreme emissions that rewarded extraction over engagement, highlighting the significance of sustainable token design. Trendy dual-token economies separate in-game utility from long-term worth and governance.

One token usually helps gameplay mechanics and frequent transactions, whereas the second token governs ecosystem selections or captures long-term market worth. This construction permits builders to fine-tune incentives, cut back inflation, and create extra sturdy in-game economies.

3. Decentralized Bodily Infrastructure Networks (DePIN)

DePIN represents one of the sensible evolutions of tokenomics, extending blockchain incentives into the bodily world. These networks use tokens to coordinate the deployment and operation of infrastructure corresponding to wi-fi connectivity, information storage, vitality programs, and sensor networks.

Tokenomics in DePIN fashions should instantly replicate real-world efficiency. Rewards are sometimes tied to metrics corresponding to uptime, protection, information accuracy, or service demand, guaranteeing tokens replicate precise utility fairly than passive participation.

Conclusion

In abstract, tokenomics is a vital issue that determines a crypto mission’s sustainability, separating these with long-term potential from these doomed to fail. When investing, you will need to analysis the mission’s tokenomics to grasp its provide construction, incentives, utility, and governance. This information will show you how to make knowledgeable selections on the tokens you need to spend money on.

FAQs

What’s an instance of tokenomics?

Bitcoin is without doubt one of the clearest examples of tokenomics in apply. Its mounted max provide, predictable issuance schedule, and halving mechanism have been designed to create shortage and resist inflation. One other instance is Ethereum, the place tokenomics balances utility, community safety, and provide administration by means of fuel charges, staking, and token burning.

Why do some tokens have limitless provide?

Some tokens have a limiteless token provide to assist ongoing community incentives and long-term sustainability. In networks that depend on validators or miners, steady issuance helps reward members for securing the system.

What is the distinction between circulating provide and complete provide?

Circulating provide refers back to the variety of tokens presently obtainable available on the market and freely tradable by customers. In the meantime, complete provide contains all tokens which have been minted, even these which might be locked, vested, or reserved for future use.

What’s good tokenomics?

Good tokenomics aligns incentives throughout all members in a community. It encourages actual utilization, helps long-term safety, and distributes worth pretty with out extreme inflation or centralization. A powerful tokenomics mannequin is clear, predictable, and resilient throughout market cycles, permitting the ecosystem to develop with out counting on fixed hypothesis.

The place can I discover the tokenomic data for a crypto asset?

You’ll find tokenomics particulars in a mission’s whitepaper or official documentation. You too can examine platforms like CoinMarketCap or CoinGecko for provide information, and use blockchain explorers to confirm distribution and token actions on-chain.