Liquid staking is a decentralized finance (DeFi) protocol that permits merchants to stake their digital property on proof-of-stake (PoS) blockchains whereas sustaining liquidity. As an alternative of locking up crypto and dropping entry to it till the top of a lock-up interval, as is finished in conventional staking, customers obtain tokenized representations of their staked property (referred to as liquid staking tokens or LSTs).

LSTs are pegged 1:1 to the worth of the staked tokens, and traders can deploy them on different DeFi protocols to generate extra staking rewards from yield farming. Other than incomes yields, liquid staking reduces alternative prices for traders as they will use their staked property to fulfil different functions.

Prior to now, when traders staked their property, they turned illiquid till the lockup interval was exhausted. Liquid staking was launched to deal with the liquidity concern in blockchains using the PoS consensus mechanism, permitting traders to earn rewards whereas partaking in DeFi actions resembling lending or buying and selling.

On this article, we are going to clarify in additional element what liquid staking is, the distinction between conventional staking and liquidity staking, what liquid staking tokens and protocols in crypto are, and the best way to get began with liquid staking. Let’s start!

What’s Liquid Staking?

Liquid staking is a comparatively new crypto idea that permits traders to stake their crypto property on Proof-of-Stake blockchains, resembling Ethereum, and nonetheless take part in different decentralised finance (DeFi) actions, like yield farming. Not like conventional staking providers, the place property are locked and stay inaccessible for a set period, liquid staking provides traders receipt tokens representing the staked asset, LST.

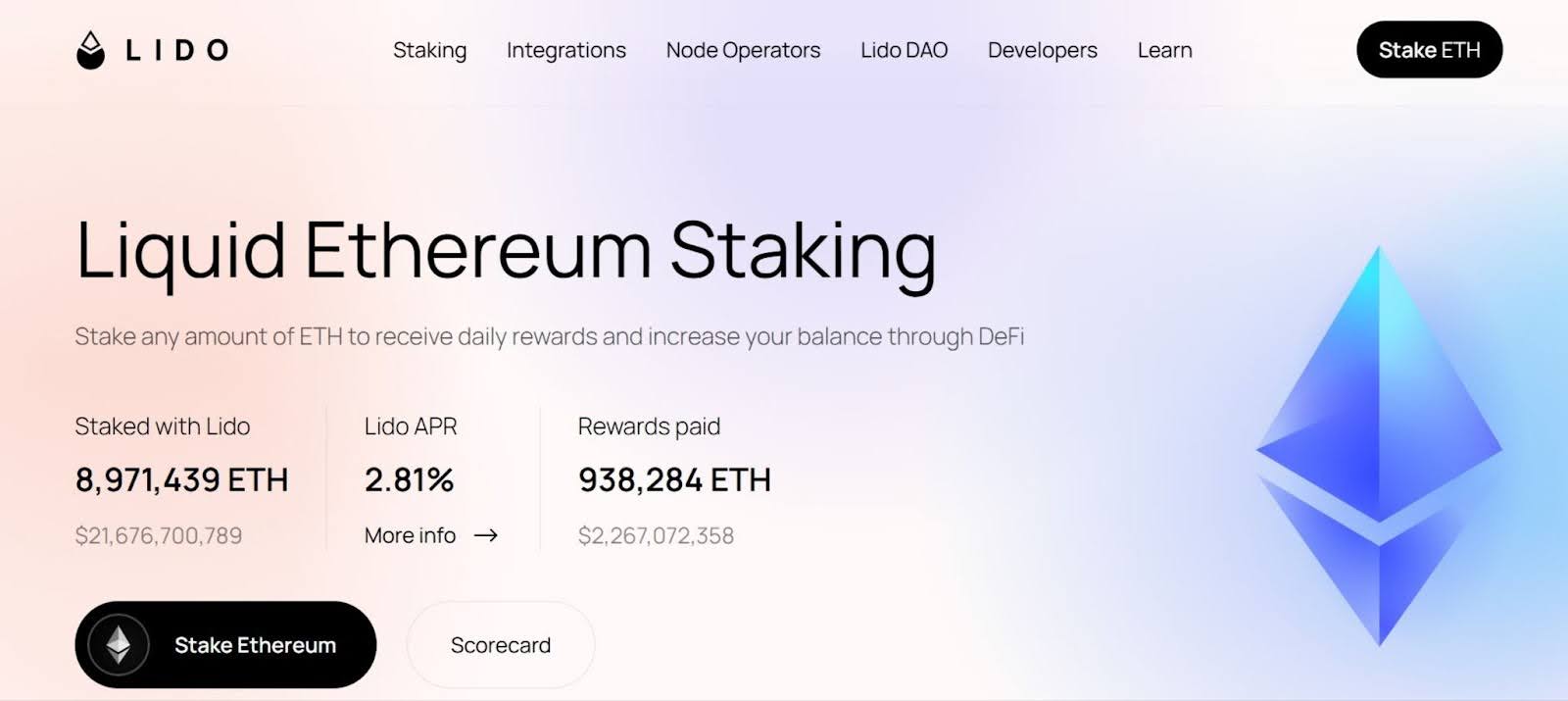

These LSTs will be traded, used as collateral, or built-in into a number of decentralized finance (DeFi) protocols. For instance, when staking Ethereum by means of Lido Finance, customers obtain Lido Staked ETH (stETH), which represents their staked ETH. With Lido’s native receipt token, you may generate yields, use as collateral, commerce, and fulfil different functions on different DeFi protocols.

How Does Staking Work?

Staking works by permitting customers to lock a specific amount of tokens in a pockets or sensible contract as collateral. The blockchain community then selects validators from those that have staked property primarily based on the quantity staked and different standards. The validators verify transactions and add new blocks to the blockchain, and in return, validators obtain rewards paid within the community’s tokens.

However what’s staking precisely? Merely put, staking is a option to earn rewards by placing your idle crypto property to work on proof-of-stake blockchains. In conventional staking, traders lock up property they don’t seem to be actively buying and selling in change for rewards after a particular interval, sometimes starting from three to 18 months.

Throughout this era, the staked property can’t be traded, transferred, or utilized in different actions. Whereas this helps keep community integrity, it additionally limits asset liquidity and restricts customers from maximizing the utility and potential returns of their holdings. Therefore, liquid staking was launched to enhance capital effectivity.

How Does Liquid Staking Work?

Liquid staking allows customers to stake their cryptocurrency in a Proof-of-Stake (PoS) community whereas nonetheless retaining liquidity by means of the issuance of receipt tokens. It takes the standard staking mannequin a step additional by permitting customers to make use of their staked property for different actions on DeFi protocols. Right here’s the way it achieves this capital effectivity:

A person deposits their cryptocurrency right into a liquid staking protocol or pool.The protocol stakes these property on the person’s behalf to take part within the PoS community.In return, the person receives a liquid staking token (LST) or by-product token that represents their staked property.This by-product token will be freely traded, lent, or used as collateral within the DeFi ecosystem, offering liquidity whereas the unique property stay staked.The staked property proceed to earn staking rewards, that are mirrored within the worth of the liquid staking tokens.

When the person needs to withdraw their authentic property, they return the receipt tokens to the protocol, which then unstakes and releases the unique cryptocurrency. This mechanism permits customers to earn rewards with out dropping entry to their property, enabling them to make use of their staked tokens in different monetary actions.

What are the Benefits of Liquid Staking?

Some great benefits of liquid staking are enhanced liquidity and suppleness, decreased alternative price, and steady rewards.

Enhanced Liquidity and Flexibility: Liquid staking lets merchants preserve their tokens accessible whereas incomes rewards. By offering traders with extra tokens (LSTs), they will extract liquidity with out unstaking their crypto property.Decreased Alternative Value: In conventional staking, traders can’t entry their locked-up property till the lock-up interval is exhausted. Which means they will’t use the property to take part in some other exercise. Liquid staking removes the barrier of ready by means of lengthy lockup durations, so that you don’t miss possibilities to react to market modifications.Steady Rewards: Incomes rewards in your base tokens doesn’t cease while you obtain the tokenized property; you’ll proceed to earn staking rewards on the unique tokens. Once you wish to unstake your property, you may redeem your LSTs by means of the protocol to retrieve the underlying tokens.

What are the Challenges and Dangers of Liquid Staking?

The challenges and dangers of liquid staking embrace validator slashing, worth instability, and protocol reliability points.

Validator Slashing: When tokens are staked, they’re typically managed by validators who assist safe the blockchain. If a validator behaves dishonestly or fails to observe the principles, resembling being offline for too lengthy, the community can punish them by slashing a portion of the staked property. This impacts everybody whose property are tied to that validator, together with customers who maintain liquid staking tokens, thereby lowering the whole worth backing these tokens. Value Instability: The token you obtain by means of the liquid staking course of doesn’t all the time match the precise worth of the unique cryptocurrency it represents. For instance, a liquid staking token would possibly commerce at a reduction throughout unsure market situations. If demand falls or customers rush to exit concurrently, the worth can drop beneath the worth of the underlying asset, leading to losses when trying to promote or commerce. Protocol Reliability: Customers depend on the liquid staking protocols to function transparently, keep system safety, and handle the technical facets with out errors. If the group behind the protocol fails to take care of the platform, or if the challenge is deserted or compromised, it might change into troublesome or unattainable to entry the staked tokens.

What are Restaking and Liquid Restaking Tokens (LRTs)?

Restaking is the method of utilizing property which have already been staked on one blockchain to safe extra networks and protocols with no need to unstake the unique token. Restaking helps prolong the safety of 1 community throughout others, as a substitute of locking up extra property.

In the meantime, Liquid Restaking Tokens (LRTs) are a option to preserve entry to your restaked property, much like how liquid staking tokens work. LRTs provide you with a token that represents your place within the restaking course of. As an alternative of ready by means of lengthy lockup durations, these LRTs permit you to keep energetic available in the market with a liquid model of your restaked funding.

What are the Variations Between Conventional Staking and Liquid Staking?

The variations between conventional staking vs. liquid staking are entry to funds and suppleness.

Entry to Funds: In conventional staking, tokens are locked and can’t be moved, traded, or used elsewhere till the top of the staking interval. Some networks even have an unbonding time, which provides a delay earlier than you may withdraw your funds after unstaking.

Alternatively, when tokens are staked by means of a liquid staking platform, customers obtain a separate token that represents the quantity staked. This token stays energetic and can be utilized whereas the unique property keep locked within the community.

Flexibility: The foremost profit conventional staking presents is the staking reward. The tokens sit idle and are dedicated to the community’s safety in the course of the staking interval. Nevertheless, liquid staking allows customers to commerce tokenized property and use them as collateral. You’ll be able to earn extra yield or reposition your funding with out ready for the unique staking lock to finish.

What are the Variations Between Liquid Staking vs Native Staking?

The variations between liquid staking vs. native staking are asset accessibility, complicated staking infrastructure, and yield potential.

Asset Accessibility: Liquid staking allows customers to stake their property by means of a platform that locks them up after which points a corresponding token in return. This new token represents your staked property and might nonetheless transfer round freely. Nevertheless, native staking locks property throughout the community for a set time till the unstaking interval. Complicated Staking Infrastructure: In liquid staking, a separate platform handles the staking and token issuance. Subsequently, traders want to know how the liquid token capabilities and the best way to handle it throughout DeFi environments. Whereas in native staking, the method is usually simple, utilizing official wallets or validators with minimal interplay. Yield Potential: The liquid staking token can generate extra yield when utilized in lending protocols, liquidity swimming pools, or different DeFi merchandise. In the meantime, in native staking, rewards are restricted to the bottom staking yield supplied by the blockchain. No additional incomes alternatives exist except the property are unstaked and reallocated elsewhere.

What are the Variations Between Liquid Staking vs. Pool Staking?

The variations between liquid staking vs. pool staking are liquidity, flexibility, management, and DeFi participation.

Liquidity: Liquid staking means that you can obtain an energetic receipt token that represents your staked property. In the meantime, pool staking locks your cryptocurrency holdings for a set interval. You lose entry to them till you determine to unstake. DeFi Participation: Liquid staking integrates with the DeFi ecosystem. You should use the tokenized model of your stake in liquidity swimming pools, lending protocols, or different yield-generating methods. On the flip facet, pool staking isolates your property, so when you earn staking rewards, these funds stay unavailable for the rest.

What’s the Distinction Between Liquid Staking vs. Restaking?

The distinction between liquid staking vs. restaking are performance, threat profile, and reward technique.

Performance: Liquid staking includes staking as soon as and receiving a tradable token in return. This token represents your authentic stake and can be utilized throughout numerous DeFi protocols. Restaking, nonetheless, builds upon an current stake. You are taking property which can be already staked and delegate them to extra networks or providers to earn extra rewards. Danger Profile: Liquid staking ties your threat to at least one staking protocol and the token it points. On the flip facet, restaking will increase your publicity, leaving you susceptible. If any of the extra platforms fail, or if the method isn’t safe, your rewards and even your authentic property might be affected. Reward Technique: Liquid staking focuses on utility and mobility. You earn rewards whereas preserving your capital energetic. In the meantime, restaking goals for increased returns by maximizing each alternative to place the identical stake to work. Whereas this will enhance earnings, it additionally will increase the prospect of a loss if one hyperlink within the chain breaks.

What’s a Liquid Staking Token and Protocol in crypto?

A Liquid Staking Token is the tokenized model of your staked crypto that the protocol provides you. It represents the quantity you staked and the rewards you might be incomes over time. In the meantime, the Liquid Staking Protocol is a DeFi platform that permits customers to stake their tokens whereas sustaining liquidity.

Which Liquid Staking Tokens are Most In style?

The most well-liked liquid staking tokens are stETH, rETH, cbETH, and mSOL. These tokens symbolize staked property on main blockchain networks, resembling Ethereum and Solana. For Ethereum liquid staking, stETH is issued by Lido Finance, rETH is supplied by Rocket Pool, and cbETH is issued by Coinbase. On the Solana facet, mSOL is likely one of the prime choices, issued by Marinade.

How Does Liquid Staking Work With Totally different Cryptocurrencies?

Liquid staking works in another way throughout numerous blockchains, relying on how every community handles staking and validator participation. Within the case of Ethereum liquid staking, traders can stake ETH by means of platforms like Lido Finance, Rocket Pool, or Coinbase and obtain tokens resembling stETH, rETH, or cbETH in return. These tokens symbolize the staked ETH and accumulate rewards over time, whereas nonetheless being usable throughout DeFi protocols.

In the meantime, Solana liquid staking follows an analogous mannequin however is tailor-made to the Solana community’s structure. Protocols like Marinade and Jito supply customers tokens, resembling mSOL or jitoSOL, which mirror their staked SOL and allow them to stay energetic throughout the Solana ecosystem. Whereas the mechanics are totally different for numerous cryptocurrencies, the objective throughout all networks is to offer staking rewards with out locking up the underlying asset.

Learn how to Get Began with Liquid Staking?

Listed here are steps on the best way to get began with liquidity staking.

Step 1. Choose a Trusted Liquid Staking Platform

Step one is to determine which liquid staking platform to make use of. This selection is determined by the blockchain you’re excited about. For instance, should you’re working with Ethereum, platforms like Lido, Rocket Pool, or Ether.fi are frequent. On Solana, you would possibly discover Marinade or Jito. For the Cosmos ecosystem, Stride and Persistence are two widespread choices.

Step 2: Arrange a crypto pockets

When you’ve picked a platform, head over to their official web site and join your crypto pockets. The pockets you utilize must be appropriate with the blockchain you might be staking on. For the Ethereum community, MetaMask is a well-liked selection.

In the event you’re staking on Solana, Phantom is an effective choice, and for Cosmos, Keplr is usually used. Ensure you have the native token of that blockchain in your pockets—like ETH, SOL, or ATOM—in addition to a small quantity to cowl transaction charges. In the event you’re nonetheless not sure which one to decide on, take into account beginning with one from our record of the perfect crypto wallets to make sure compatibility and safety.

Step 3: Stake Your Tokens and Obtain Liquid Property

After connecting your pockets, enter the quantity of tokens you wish to stake and approve the transaction. As soon as confirmed, the platform will stake your tokens and concern a corresponding liquid token in return. For instance, should you stake Ethereum utilizing Lido, you’ll obtain stETH in return.

Token holders can both preserve liquid property of their pockets to passively earn rewards or discover alternatives in DeFi to extend their yield. If you wish to exit your place, you may both swap the liquid token again to the unique token or use the unstaking course of supplied by the platform.

What are the Greatest Practices for Liquid Staking to Cut back Dangers?

The perfect practices for liquid staking to scale back potential dangers are analysis, diversifying throughout platforms and crypto property, and managing liquidity and threat publicity.

Analysis About The Platform Earlier than Utilizing it: Do your personal analysis to know how the platform works, who constructed it, and whether or not it has been audited. Select one which has been round for some time, is trusted by the group, and has sturdy safety measures. Some security measures to look out for are multi-factor authentication, chilly storage, common safety audits, insurance coverage protection, and bug bounty packages. Diversify Throughout Platforms and Crypto Property: Use liquid staking protocols with a confirmed observe document, sturdy safety protocols, and clear governance buildings. Platforms like Lido and Rocket Pool have undergone rigorous safety audits and keep open-source sensible contracts, which helps scale back counterparty and sensible contract dangers.

Moreover, it’s advisable to unfold your staked tokens throughout a number of platforms that supply liquid staking providers. This diversification reduces publicity to slashing occasions, platform insolvency, or sensible contract vulnerabilities that would have an effect on one service supplier however not others.

Handle Liquidity and Danger Publicity

Hold some unstaked or liquid property apart to take care of flexibility in case of market downturns or protocol points. Use threat administration methods, resembling place sizing and stop-loss orders, the place relevant, to restrict potential losses during times of volatility.

Is Liquid Staking a Taxable Occasion?

Sure, liquid staking is a taxable occasion. Once you stake and obtain liquid staking tokens, it’s typically handled as promoting your authentic crypto and shopping for a brand new token, which can set off capital features tax. Additionally, the staking rewards you earn are taxable as earnings.

Is Liquidity Staking Value It?

Sure, liquid staking is price it, particularly if you wish to earn staking rewards and discover DeFi protocols with out sacrificing liquidity.

If you wish to take your crypto journey additional, discover the greatest crypto futures buying and selling platforms that assist liquid staking and permit merchants and token holders to discover fundamental and superior instruments for crypto buying and selling. Plus, don’t miss out on unique crypto sign-up bonus codes providing charge reductions and extra rewards for brand spanking new customers on prime crypto exchanges.