Victoria d’Este

Printed: January 22, 2025 at 10:28 am Up to date: January 22, 2025 at 10:29 am

Edited and fact-checked:

January 22, 2025 at 10:28 am

In Temporary

The US cryptocurrency market has skilled a big shift resulting from shopper preferences, legislative modifications, and technological developments, affecting exchanges, platforms, and distinguished gamers.

In recent times, there was a dramatic shift within the cryptocurrency market within the US resulting from modifications in shopper tastes, legislative modifications, and technological breakthroughs. With an emphasis on exchanges, platforms, and distinguished gamers, we’ll study the rising acceptance of cryptocurrency options within the US market.

The US’s Current Cryptocurrency State

The cryptocurrency market is rebounding as of early 2025; in 2024, Bitcoin buying and selling volumes shall be round $19 trillion, which is double what they had been in 2023. This growth could also be ascribed to quite a few causes, together with rising institutional utilization and the emergence of spot Bitcoin exchange-traded funds (ETFs) which have offered new channels for investing. By the tip of 2025, analysts estimate that Bitcoin is perhaps price between $180,000 and $200,000 resulting from elevated curiosity from institutional and particular person traders.

The state of politics additionally has an infinite impact on how the crypto market develops. Discussions regarding potential legislative modifications that will favor digital belongings have been triggered by Donald Trump’s latest election. His administration’s emphasis on updating regulatory frameworks and making a strategic Bitcoin reserve would possibly enhance market participation and belief even additional.

The Spine of Buying and selling Cryptocurrencies

Exchanges for cryptocurrencies are important venues for the acquisition, sale, and buying and selling of digital belongings. Quite a few well-known exchanges that serve a spread of person demographics, from institutional purchasers to particular person traders, are based mostly within the US market. Crypto.com has develop into one of many main gamers amongst these exchanges.

An institutional cryptocurrency platform for expert merchants and institutional traders has just lately been launched by Crypto.com. For greater than 300 cryptocurrencies unfold throughout 480 buying and selling pairs, this platform supplies buying and selling decisions with nice liquidity and low latency. The change’s growing market status could also be attributed to its dedication to person safety and regulatory compliance.

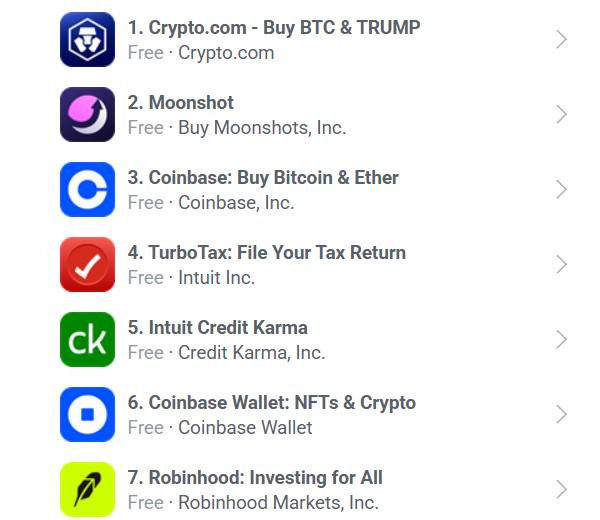

Different exchanges like Coinbase and Binance have additionally made a reputation for themselves as important individuals along with Crypto.com. Previous to Crypto.com’s fierce competitors in latest months, Coinbase was essentially the most downloaded monetary app on the iOS App Retailer.

The truth that Crypto.com rose to the highest of the US iOS App Retailer’s monetary app rankings reveals how fashionable it’s with customers. With greater than 100 million customers worldwide, Crypto.com affords a full vary of companies, together with buying and selling, staking, and reward-earning on cryptocurrency holdings. Each new and skilled merchants are drawn to its easy interface and wealth of coaching supplies.

A Visa card that gives cashback on cryptocurrency purchases and entry to a spread of DeFi companies are two of the platform’s distinctive traits. These companies set up Crypto.com as a versatile platform that may meet a spread of buyer necessities.

Current occasions present that Crypto.com is making progress in drawing in institutional purchasers along with its retail person base. Its deliberate intention to extend its share of this worthwhile market is proven within the opening of its specialised change for establishments.

Adoption by the Native Establishments

An essential change within the crypto market is the rising curiosity from institutional traders. Cryptocurrencies are beginning to be acknowledged by main monetary establishments as engaging funding choices. In keeping with stories, company Bitcoin holdings are predicted to extend from $24 billion in 2024 to over $50 billion in 2025.

An essential issue on this shift has been the introduction of Bitcoin ETFs. ETFs give institutional traders a less complicated technique to have cryptocurrency publicity whereas nonetheless following authorized necessities. Huge capital inflows caused by new establishments coming into the market have the potential to lift costs and scale back market volatility.

Moreover, as firms seek for efficient strategies to hold out cross-border transactions, economists forecast that stablecoin use will enhance dramatically. It’s anticipated that this tendency would strengthen the crypto ecosystem as a complete by enhancing liquidity and enabling clean transactions throughout a number of platforms.

Regulatory Surroundings: Dealing with Difficulties

The cryptocurrency regulatory panorama continues to be dynamic and complex. Clearer guidelines might outcome from the present coverage change underneath Trump’s administration, which might be advantageous to exchanges and traders alike. The implementation and enforcement of those restrictions are nonetheless up within the air, although.

Up to now, regulatory monitoring has elevated in response to high-profile occasions like Terra/Luna and FTX. Exchanges like Crypto.com had been pressured to reevaluate their actions within the US market on account of these occurrences. As a way to protect aggressive benefits and guarantee compliance, exchanges might want to modify their strategies as legal guidelines develop extra exact.

Tendencies Affecting the Cryptocurrency Market in america

Key components are influencing the way forward for the U.S. cryptocurrency sector, which is presently altering. As extra monetary establishments embrace digital belongings, it’s anticipated that institutional participation will enhance, leading to the next want for regulated funding decisions and extra stability.

Stablecoins will most likely increase quicker, giving firms a reliable, much less risky device for worldwide transactions. In the identical means, tokenizing bodily belongings like shares and actual property would possibly enhance market liquidity and enhance accessibility to traders by permitting fractional possession.

Using AI in blockchain techniques has the potential to reinforce safety and effectivity, facilitating extra clever threat administration and extra environment friendly transactions. Decentralized finance’s ongoing development can even supply monetary companies outdoors of conventional banks, encouraging wider utilization and innovation.

Because of rising shopper tastes, authorized modifications, and know-how enhancements, bitcoin options have gotten an increasing number of fashionable within the US market. We might anticipate extra conventional monetary establishments taking part in addition to ongoing innovation in decentralized finance as regulatory frameworks develop into extra express underneath the brand new political management.

The cryptocurrency market continues to be evolving, with many prospects for enlargement in quite a lot of industries. Making smart funding selections in an more and more digital financial system will rely upon stakeholders’ skill to understand these patterns as they navigate this altering surroundings.

Disclaimer

In step with the Belief Venture tips, please observe that the knowledge offered on this web page is just not supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. It is very important solely make investments what you’ll be able to afford to lose and to hunt impartial monetary recommendation when you’ve got any doubts. For additional data, we advise referring to the phrases and circumstances in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Creator

Victoria is a author on quite a lot of know-how subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of know-how subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.