Decentralized finance hinges on Chainlink (LINK). This oracle community shatters boundaries between blockchain and real-world information, making good contracts useful and dependable. However the LINK worth appears undervalued; how can that be?

Blockchains want this service as a result of they act as remoted networks; they can’t retrieve or ship information to an off-chain resolution.

Right here’s why LINK is a very powerful DeFi protocol.

The Nitty Gritty of How Chainlink Works

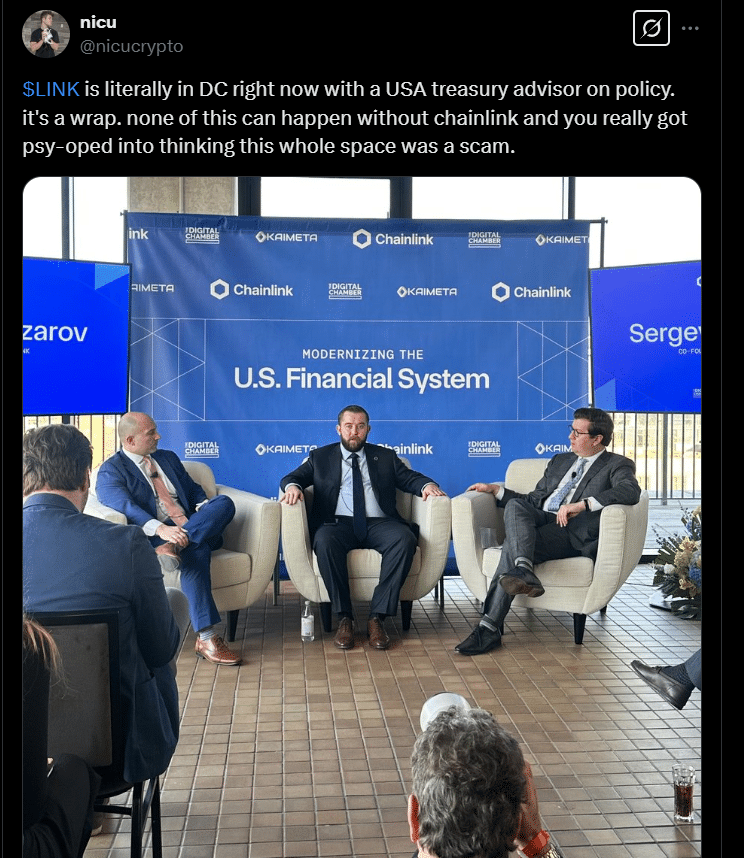

Sergey Nazarov created Chainlink in 2014 and launched it in 2017. As a widely known cryptocurrency, it’s listed on all the common crypto-trading platforms, together with Kraken, Binance, Gemini, and Coinbase.

With out Chainlink, blockchains couldn’t obtain mandatory information from exterior sources, making Chainlink a extremely worthwhile challenge on this house.

7d

30d

1y

All Time

Chainlink good contracts primarily perform three foremost features.

Repute evaluation: Consider Oracles as nodes that feed data to a blockchain challenge. Oracles that act exterior of those boundaries are penalized and downgraded.

Working with exterior information: On this step, correct oracles with the very best fame are chosen, and a scientific consensus is reached concerning transferring the demanded information.

Lastly, now we have aggregation: Right here, the aggregation contract gathers all the info conveyed by the off-chain oracles after which finds the median to type a weighted combination response.

The Bull and Bear Case for LINK Worth Motion

Chainlink is the spine of crypto interoperability. It ensures that Bitcoin (BTC) and Ethereum (ETH) play properly, brings banks into the fold, and allows Wrapped Bitcoin.

With help from titans like Google and Oracle, plus a plan to safe future presidential elections with cryptographic verification, Chainlink is all over the place. Its decentralized good contracts additionally add an important layer of DeFi safety.

LINK may be essential for decentralized finance, however its critics are loud. They declare the LINK token is pointless—one other cryptocurrency, like Ethereum may simply change its function in powering Chainlink’s companies. LINK’s dependence on community exercise underscores its vulnerability, although its deflationary design may nonetheless make it a bullish asset.

Even Ethereum’s Vitalik Buterin has questioned the challenge, suggesting Uniswap may change LINK as a number one oracle. For now, LINK dominates the house, however vital challenges stay.

EXPLORE: XRP Worth Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

With out Chainlink ($LINK), decentralized finance wouldn’t exist.

For now, Chainlink dominates the house, however vital challenges stay.

The put up Why Chainlink is Extra Necessary than Most DeFi Protocols appeared first on 99Bitcoins.